AI不正検知とは

AI不正検知とは、決済情報と機械学習で不正利用を検知するサービスです。年間数億件を超える決済データによって、あらゆる不正パターンを機械学習しモデルを作成することで、人間では見分けがつかない不正パターンとの類似性をスコアとしてリアルタイムに算出することが可能になりました。モデルはチャージバックなどの不正取引データを蓄積し、再学習を行います。

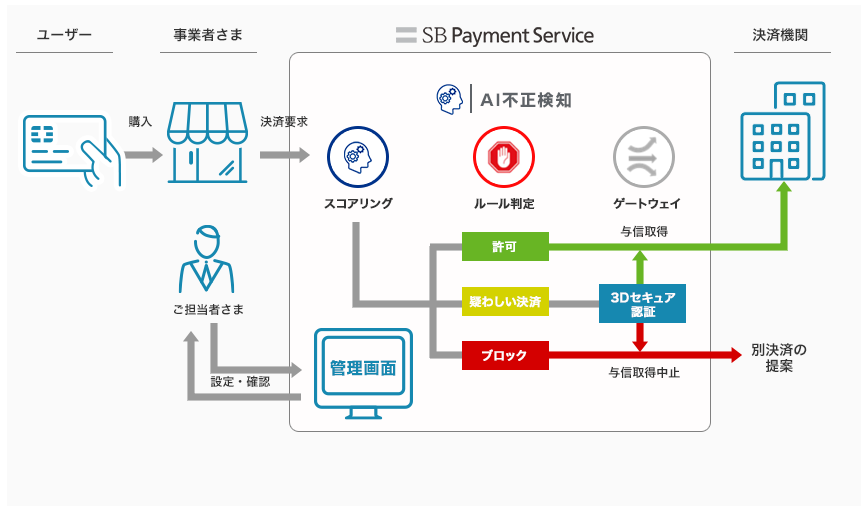

サービス概念図

利用可能な決済手段

- クレジットカード決済

主な特徴

- 機械学習を活用

過去の不正パターンを機械学習し、エンドユーザーがクレジットカード決済を行うタイミングで当該決済の不正利用のリスクをスコアとして算出します。加盟店は、リアルタイムにスコアを把握することにより、不正な取引の早期発見が可能です。 - 手軽に導入

従来の不正検知ツールの導入には加盟店からの追加情報が必要なケースが多く、画面の開発や規約改定といった導入負荷が発生していましたが、「AI不正検知」は、決済で利用している情報を利用するため、加盟店の導入負荷を軽減できます。 - 動的な対策

不正利用が疑われる取引を抑止できる加盟店独自ルールの設定や、疑わしい取引だけにEMV 3-Dセキュアの認証を追加する機能を提供します。

エンドユーザー向け利用情報

クレジットカード決済の購入手順については、サービスサイトに概要を掲載しておりますのでご確認ください。

エンドユーザー向けの利用情報についてはFAQ(決済・システム仕様>クレジットカード決済)をご確認ください。

注意事項

- リンク型を利用の場合で不正利用が疑われる取引を抑止できるルールの設定を利用する場合は、当社決済提供の購入エラー画面または加盟店指定のエラー時指定URLへ遷移します。

- API型を利用の場合は、加盟店にてAI不正検知より返却されたスコア等の検知結果情報を取得後、当該取引の提供可否を判断いただく必要があります。提供可と判断した場合は決済を行い、提供不可と判断した場合は決済を中止ください。

サービス仕様

基本仕様

利用可能な課金方式とシステム接続方式は以下のとおりです。

課金方式

| 都度課金 | ○ |

|---|---|

| 継続課金(簡易) | × |

| 継続課金(定期・従量) | × |

システム接続方式

| リンク型 | ○ |

|---|---|

| API型 | 〇 |

対応デバイス

クレジットカード決済のサービス概要を参照ください。

API型を利用の場合は、AI不正検知 IF仕様も参照ください。

提供機能一覧

以下の機能を提供しています。AI不正検知管理ツールの機能は、主な機能のみを記載しています。詳しくはAI不正検知管理ツールマニュアルにて確認ください。

| 提供機能 | リンク型 | API型 | |

|---|---|---|---|

| スコアリング | ○ | ○ | |

| ルール判定 | 〇 | 〇 | |

| ゲートウェイ | 〇 | ×※1 | |

| 追加認証(EMV 3-Dセキュア) | 〇 | ×※2 | |

| AI不正検知 管理ツール | ダッシュボード | ○ | ○ |

| 結果確認 | ○ | ○ | |

| ルール設定 | ○ | ○ | |

| シミュレーション | ○ | ○ | |

| リスト登録 | ○ | ○ | |

※2:API型を利用の場合で追加認証(EMV 3-Dセキュア)の利用を希望される場合は、当社営業まで連絡ください。

各機能の詳細は以下のとおりです。

《スコアリング》

不正利用のリスクをAIがリアルタイムにスコアとして算出する機能です。

- スコアは0から99の間で算出され、数値が高いほどリスクが高いとAIが判定した取引です。

- スコアは、AI不正検知管理ツールで確認できます。

- API型を利用の場合は、AI不正検知より返却される検知結果としても取得できます。

詳細は、AI不正検知 IF仕様をご参照ください。

《ルール判定》

加盟店がスコアリング後の当該取引の提供可否や取扱い(例.与信取得はするがアラートは上がるようにしておく)を設定できる機能です。

- 種類は、「3Dセキュア」「許可(強制)」「ブロック」「アラート」「許可」から選択できます。

- どのルールにも該当しない取引は、「判定なし」となります。

- ルール判定の設定に必要なルールの作成は、AI不正検知管理ツールで作成できます。

- ルール判定の結果は、AI不正検知管理ツールで確認できます。

- API型を利用の場合は、AI不正検知より返却される検知結果としても取得できます。

- リンク型を利用の場合は、ルール判定の結果に応じて当社決済画面の動きが変わります。

詳細は《ゲートウェイ》を参照ください。 - API型を利用の場合は、ルール判定の結果をAI不正検知より返却される検知結果として取得後、ルール判定の結果に応じて加盟店サイトの動きを変更ください。

注意事項

- 作成できるルールの数等には制限があります。「注意事項」に記載の「制限事項」を参照ください。

- ルール判定の設定に必要なルールの作成およびルールの適用は、加盟店ご自身にて実施いただく必要があります。

当社による代理でのルールの作成およびルールの適用は行いません。

《ゲートウェイ》

ルール判定の結果に応じて、当社決済画面の動きを変える機能です。

リンク型をご利用の場合は、以下のルール判定の結果に応じた当社決済画面の動きを確認ください

API型をご利用の場合は、ルール判定の結果に応じて加盟店サイトの動きを変更ください。

| ルール判定 | リンク型「支払方法」の指定内容 | |

|---|---|---|

| クレジットカード決済 | クレジットカード決済(EMV 3-Dセキュア) | |

| 3Dセキュア | ×※1 | EMV 3-Dセキュア認証を実施 |

| 許可(強制) | 与信取得 | EMV 3-Dセキュア認証をスキップし、与信取得※3 |

| ブロック | 与信取得中止※2 | 与信取得中止※2 |

| アラート | 与信取得 | EMV 3-Dセキュア認証をスキップし、与信取得※3 |

| 許可 | 与信取得 | EMV 3-Dセキュア認証をスキップし、与信取得※3 |

| 判定なし | 与信取得 | EMV 3-Dセキュア認証を実施 |

※2:当社決済画面の購入エラー画面または加盟店指定のエラー時指定URLへ遷移します。

※3:「許可(強制)」「アラート」「許可」のルールを設定すると、本人認証(EMV 3-Dセキュア)を実施しません。本人認証が実施されずに、第三者が不正に入手したカード情報で行われた取引によりチャージバック(売上金の取消)が発生した場合、加盟店負担となるのでご注意ください。

《追加認証(EMV 3-Dセキュア)》

ルール判定の設定により、EMV 3-Dセキュアの認証を追加できる機能です。

本機能を利用いただくことで、疑いがある取引だけにEMV 3-Dセキュアを実施できます。

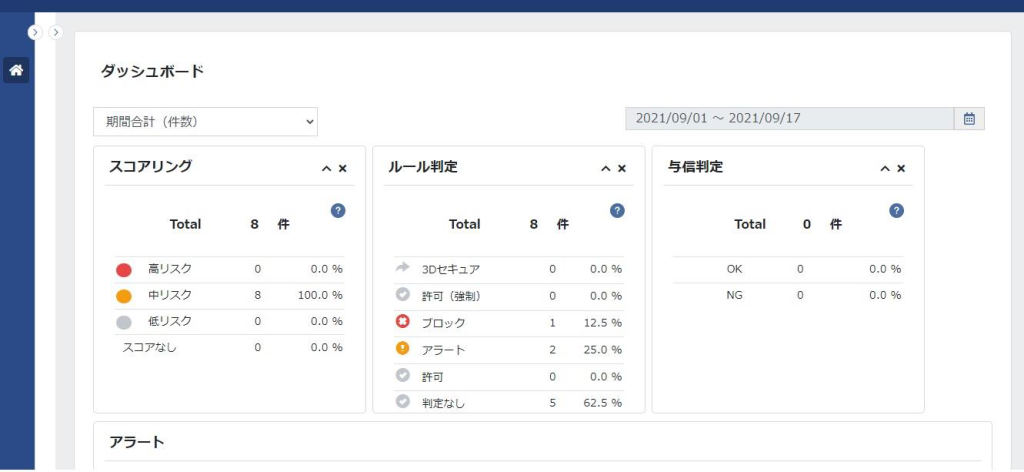

《AI不正検知管理ツール》

スコアやルール判定の結果の検索/参照、ルール判定の設定に必要なルールの作成やシミュレーション等が行える管理ツールです。AI不正検知管理ツールの操作方法は、AI不正検知管理ツールマニュアルを参照ください。

主な機能

主な機能は以下のとおりです。

- スコアやルール判定の結果の検索/参照

- 表示される項目のCSV出力

- 「ルール設定」「シミュレーション」「リスト登録」などルール判定の設定に必要な各種設定

利用イメージ

決済管理ツールとの関連

決済管理ツールで確認可能な項目のうち、AI不正検知管理ツールで確認可能な項目は以下のとおりです。

- トラッキングID

- 与信結果

- 承認番号

- 3D認証

- エラー理由

- 受注ID※1

- 顧客ID※1

- 商品ID※1

※1:API型を利用の場合は、JavaScriptで不正検知に必要な情報を送出いただいた情報がAI不正検知管理ツールに表示されます。

決済ステータス遷移

決済のステータスの遷移は、クレジットカード決済 サービス概要を参照ください。

提供プラン

AI不正検知が提供するプランは以下のとおりです。

| 提供機能 | フリープラン | スタンダードプラン | アドバンストプラン | |

|---|---|---|---|---|

| スコアリング | 〇 | 〇 | 〇 | |

| ルール判定 | × | 〇 | 〇 | |

| ゲートウェイ | × | 〇 | 〇 | |

| 追加認証(EMV 3-Dセキュア) | × | × | 〇※1 | |

| AI不正検知 管理ツール | ダッシュボード | 〇 | 〇 | 〇 |

| 結果確認 | 〇 | 〇 | 〇 | |

| ルール設定 | × | △※2 | 〇※3 | |

| シミュレーション | × | 〇 | 〇 | |

| リスト登録 | × | 〇 | 〇 | |

※2:スタンダードプランを利用の場合は、当社が提供するテンプレート(「デフォルトルールセット」といいます)が利用可能です。デフォルトルールセットの個々のルールの値は変更可能です。

※3:アドバンストプランを利用の場合は、加盟店ご自身で独自ルールの作成が可能です。

利用情報と不正検知タイミング

利用情報

AI不正検知で利用する情報は、以下のとおりです。

リンク型を利用の場合は、当社決済画面にて自動で取得します。

API型を利用の場合は、当社が提供するJavaScriptを加盟店サイトに組み込み、JavaScriptで不正検知に必要な情報を送出いただく必要があります。詳細は、AI不正検知 IF仕様をご参照ください。

| カテゴリ | 項目名 | 説明 | リンク型 | API型 |

|---|---|---|---|---|

| 決済情報 | マーチャントID | 加盟店を識別するID | 〇 | 〇 |

| サービスID | 加盟店のサービスを識別するID | 〇 | 〇 | |

| クレジットカード番号※1 | 〇※3 | 〇 | ||

| クレジットカード有効期限 | 〇※3 | 〇 | ||

| 顧客ID | 加盟店にて管理されている顧客ID | 〇 | 〇 | |

| 購入ID | 加盟店にて管理されている購入ID | 〇 | 〇 | |

| トークン※2 | 取得したワンタイムトークン | ‐ | 〇 | |

| 金額(税込) | 税込の課金金額 | 〇 | 〇 | |

| リクエスト日時 | 〇 | 〇 | ||

| デバイス情報 | IPアドレス | 〇※4 | 〇※5 | |

| UserAgent | 〇※4 | 〇※5 | ||

| ブラウザの言語 | 〇※4 | 〇※5 | ||

| ページ滞在時間 | 〇※4 | 〇※5 | ||

| 遷移元ページ | 〇※4 | 〇※5 | ||

| 固有情報※6 | 商品ID | 加盟店にて管理されている商品ID | 〇 | 〇 |

| 商品名称 | 任意の商品名 | 〇 | 〇 | |

| 商品点数 | × | 〇 | ||

| 商品カテゴリ | × | 〇 | ||

| キャンペーンコード | × | 〇 | ||

| マーチャント使用欄 | フリー欄 | × | 〇 |

※2:ワンタイムトークン発行を伴う場合に利用できます。

※3:当社決済画面にてエンドユーザーが入力します。

※4:当社決済画面にて自動で取得します。

※5:当社が提供するJavaScriptを加盟店サイトに組み込むことで取得します。

※6:商品ID以外の項目は、任意で利用いただける項目です。

不正検知タイミング

リンク型を利用の場合は、不正検知タイミングは「購入内容確認画面」の後に行います。

API型を利用の場合は、不正検知タイミングを加盟店で任意に選択できますが、購入内容の確認画面の後など、金額が確定し、エンドユーザーが購入確定をするタイミングで行うことを推奨します

注意事項

サービスの利用にあたって

AI不正検知は、非対面取引における不正利用の被害拡大を防止することを目的として提供されるものであり、検知結果が正確かつ完全であることを当社が保証するものではありません。

加盟店は自己の責任においてこの取引を処理するかの決定が必要です。

そのため、検知結果が不正利用の懸念が指摘されていない決済であった場合であっても、チャージバックが確定した場合、当該売上金額は精算対象外となり、加盟店負担となります。

制限事項について

AI不正検知に関する制限事項・注意事項は、以下のとおりです。

| No | 内容 | 制限・注意 |

|---|---|---|

| 1 | レスポンス時間の上限 | AI不正検知は、レスポンス時間が1秒を超えた場合、クレジットカード決済の処理を優先させるため、スコアリングやルール判定等を行いません。 1秒を超えた場合、 リンク型を利用の場合は、与信取得を行います。※1 API型を利用の場合は、エラーを返却します。※2 |

| 2 | スコア照会可能期間 | スコア判定後365日。 |

| 3 | 結果確認(注文(一覧))での照会可能数上限 | 照会可能数は10,000件。 |

| 4 | 結果確認(顧客(一覧))での顧客ID照会可能数上限 | 照会可能数は1,000件。 |

| 5 | ルール作成数およびリスト登録数上限 | サービス単位あたり400KB。 目安は、ルールセットが10個、リストがリスト単位あたり1000個。 |

| 6 | シミュレーション結果照会可能数上限 | 照会可能数は100個。 |

| 7 | シミュレーション実行可能期間 | リンク型とAPI型で異なります。 リンク型を利用の場合は、2020年11月1日以降に発生した決済についてシミュレーションが可能です。※3 API型を利用の場合は、当社が提供するJavaScriptを加盟店サイトに組み込みが完了した日以降に発生した決済についてシミュレーションが可能です。 |

| 8 | 決済管理ツール関連項目の反映時間 | 決済管理ツールに関連する項目は、AI不正検知管理ツールで参照いただけるまでに時間がかかります。 目安は、スコアリングを行った判定日時から3時間後です。 |

| 9 | 自動ブロック | AI不正検知は、過去1時間以内の同一クレジットカードでの取引回数の合計が1,000回を超えた場合、 1,001回目の取引からルール判定を「ブロック」で返却します。なお、スコアリングは行いません。 |

| 10 | スコアの詳細の照会可能期間 | スコア判定後原則30日。 |

| 11 | IPアドレス(国) | IPアドレス(国)は、取得したIPアドレスを元に表示します。ただし、確実性を保証するものではありません。 なお、IPアドレス(国)が不明な場合は、空欄で表示されます。 |

| 12 | デフォルトルールセットの適用状態 | 初めて利用する場合は、デフォルトルールセットは適用されていない状態(未適用)です。 加盟店は、自己の責任においてルールセットの適用等(ルール内容 の確認、値の変更を含む)を行ってください。 ルールセットを適用中にすると、即時にルールが適用されます。 |

※2:エラーコードは、AI不正検知 IF仕様をご参照ください。

※3:AI不正検知対応画面への切り替えが必要な場合は、当該画面への切り替え完了日以降に発生した決済についてシミュレーションが可能です。

プランの変更について

加盟店は、利用契約の途中にAI不正検知のプランの変更が可能です。

プランの変更を希望する場合は、当社営業担当に連絡ください。

プランを変更した場合、各プランによって操作権限が異なるためご注意ください。

- プランのアップグレード時について

プランをアップグレードした場合、アップグレードする前のルール設定でプランのアップグレード後もAI不正検知を利用するか否かの確認を行い、必要に応じて新たにルール設定等を行ってください。

- プランのダウングレード時について

プランをダウングレードした場合、ダウングレードする前のルール設定を削除し、新たにルール設定等を行う必要があります。

メンテナンス等によるサービス停止

AI不正検知は、不定期にメンテナンスを行います。メンテナンスによるサービス停止がある場合はあらかじめ通知のうえ、サービス停止します。1週間前までに通知することを基本としています。ただし、緊急メンテナンスによる場合はその限りではありません。

また、当社のシステム以外で、AI不正検知のシステムメンテナンスや不具合によるサービス停止が発生した場合、状況がわかり次第、速やかに加盟店に通知のうえ、原因究明をします。原因判明でき次第、加盟店に通知するようにしますが、当社に起因しない場合、原因判明に時間がかかる場合があることをご了承ください。

補足情報

本書では、補足情報はありません。

用語の定義

AI不正検知のドキュメントに使用する用語の定義は、以下のとおりです。

| 用語 | 類義語 | 定義 |

|---|---|---|

| 取引 | 決済 | 加盟店とエンドユーザー間の売買取引における金銭のやりとり |

| スコア | – | エンドユーザーが入力したクレジットカード情報の不正利用リスクを算出した結果のこと |