クレジットカード決済とは

クレジットカード決済とは、クレジットカード会社が提供する決済手段です。カード番号や有効期限などを利用して、商品等の代金支払いを行うことができます。

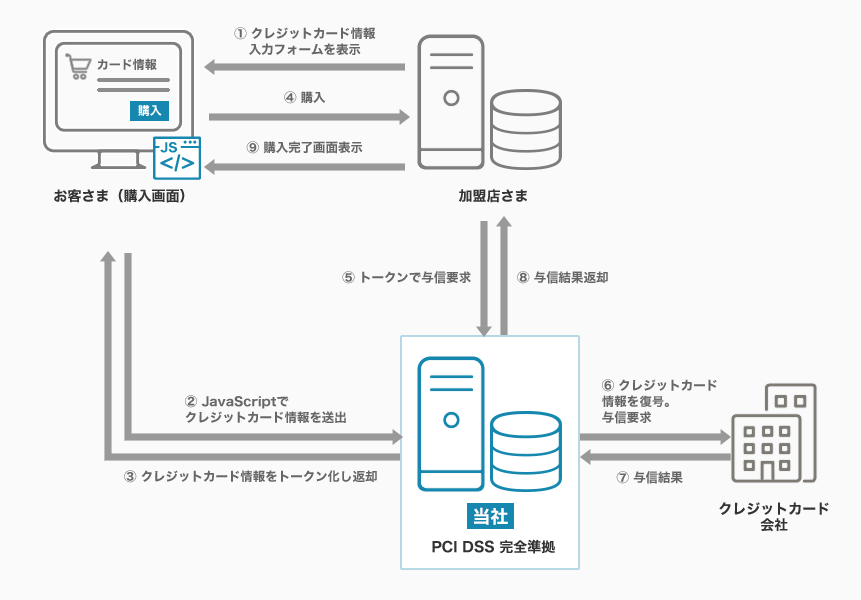

サービス概念図

主な特徴

- 5大国際ブランド(VISA、MasterCard、JCB、Diners Club、American Express)のクレジットカードの取り扱いが可能です。

- 通常の一括払いのほか、分割払い・リボ払いにも対応しています。

- 不正利用を防止するための本人認証サービス(EMV 3-Dセキュア)、セキュリティコード(CVV2)認証等を提供しています。

エンドユーザー向け利用情報

購入手順については、サービスサイトに概要を掲載しておりますのでご確認ください。

エンドユーザー向けの利用情報についてはFAQ(決済・システム仕様>クレジットカード決済)をご確認ください。

サービス利用条件

エンドユーザーのサービス利用条件は以下のとおりです。

| 利用可能なエンドユーザー |

|

|---|---|

| 利用可能額 |

|

| その他 |

|

決済時認証方法

エンドユーザーが決済時に求められる認証方法は以下のとおりです。

| 認証方法 | 説明 | 備考 |

|---|---|---|

| クレジットカード 番号、 有効期限 | クレジットカードの表面に記載されているカード番号と有効期限(月/年)です。 クレジットカード情報を保管していない場合に、クレジットカード番号と 有効期限の入力が必要になります。 | – |

| 本人認証サービス EMV 3-Dセキュア | リスクベースの認証をカード利用者の決済情報等を基に、取引の大半は 追加認証なしに認証が完了、高リスクと判断される取引にのみ、 ワンタイムパスワード等の追加認証が実施されます。 | – |

| セキュリティコード (CVV2) | クレジットカードの表面または裏面に記載されている数字です。 決済時に入力が必要になります。 | ※VISA / MasterCard / JCB / Diners の場合、 カード裏面のサイン欄に記載されている数字です。 ※American Expressの場合、カード表面のカード番号の 上に印記載されている数字です。 |

| 画像認証 | クレジットカード番号入力画面に自動的に表示される数字です。 | – |

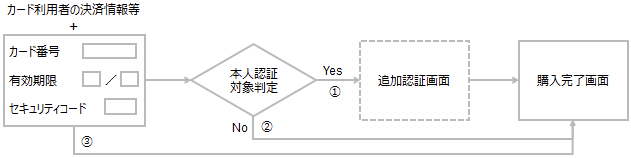

《本人認証サービス》

EMV 3-D セキュアでは、リスクベースの認証をユーザーのデバイス情報(※5)、カード利用者の決済情報等(※1)を基に、取引の大半は、追加認証なし(※2※3)に認証が完了、高リスクと判断される取引にのみ、ワンタイムパスワード等の追加認証(※4)が実施されます。そして、リスクベースの認証により、入力の手間やパスワード失念等、従来の3Dセキュアの課題を大幅に改善し、安全かつスピーディーなオンライン決済を実現しながらも、顧客の利便性やかご落ち率改善による売上向上が期待できます。

※1:カード利用者決済情報等の連携方法について、EMV 3-Dセキュア認証システムをご参照ください。

※2:加盟店よりご連携頂くカード利用者決済情報等に対し、カード会社が追加認証の要否を判断しますので、より多く、正確な情報をご連携頂ければ、追加認証なしの可能性も高くなると言われております。

なお、カード名義・電話番号・メールアドレスについてはSBPSリンク型決済画面でも取得可能となります。(↓画面イメージをご確認ください)

※3:追加認証なしの場合、フリクションレスフローとよばれます。

※4:追加認証の場合、チャレンジフローとよばれます。

※5:以下デバイス情報を自動取得します。

ブラウザのアセプトヘッダー

IPアドレス

JAVA使用可否

ブラウザ言語設定

ブラウザの色

ブラウザの高さ

ブラウザの横幅

ブラウザの時間帯

ユーザーエージェント

認証結果(ECI値)は、決済管理ツールにてご確認いただけます。

| 認証結果 | VISA | MasterCard | JCB | DinersClub | American Express |

|---|---|---|---|---|---|

| 認証成功 ※チャージバック カード発行会社負担 | ECI05 | ECI02 | ECI05 | ECI05 | ECI05 |

| 認証試行 ※チャージバック カード発行会社負担 | ECI06 | ECI01 | ECI06 | ECI06 | ECI06 |

| 認証失敗 ※チャージバック 加盟店負担 | ECI07 | ECI00 | ECI07 | ECI07 | ECI07 |

本人認証サービスは、申込み時の設定内容により、挙動が異なりますので、以下にて確認ください。

| 設定内容 | 説明 |

|---|---|

| 利用する (標準:ECI05/06) | リスクベースの認証をカード利用者の決済情報等を基に、追加認証なしに認証が完了(フリクションレス)、または、 高リスクと判断される取引にのみ、ワンタイムパスワード等の追加認証(チャレンジフロー)が実施されます。(ECI05またはECI02) ※画面遷移は、以下の利用イメージの①または②となります。 また、カード発行会社が、EMV3-Dセキュアに対応していない等、カード発行会社起因で認証が出来ない場合は、認証免除で購入が可能です。(ECI06またはECI01) ※画面遷移は、以下の利用イメージの③となります。 |

| 利用する (完全:ECI05のみ) | リスクベースの認証をカード利用者の決済情報等を基に、追加認証なしに認証が完了(フリクションレス)、または、 高リスクと判断される取引にのみ、ワンタイムパスワード等の追加認証(チャレンジフロー)が実施されます。(ECI05またはECI02) ※画面遷移は、以下の利用イメージの①または②となります。 ※本設定をお申込の場合は営業までお問合せください。 |

| 利用しない | 本人認証を行わず、通常のクレジットカード決済を行います。 ※画面遷移は、以下の利用イメージの③となります。 |

利用イメージは、以下のとおりです。

本人認証サービスが利用可能なクレジットカードブランドは、以下のとおりです。

| VISA | MasterCard | JCB | DinersClub | American Express |

|---|---|---|---|---|

| ○ | ○ | ○ | ○ | ○ |

〈VISA〉

http://www.visa.co.jp/personal/security/onlineshopping.shtml

〈MasterCard〉

http://www.mastercard.co.jp/personal/securecode/sc-issuers.html

〈JCB〉

http://www.jcb.co.jp/Jsecure/whats.html

〈American Express〉

https://www.americanexpress.com/jp/customer-service/safekey-faq.html

〈DinersClub〉

https://www.diners.co.jp/ja/merchant/protectbuy.html

本人認証サービスの画面に表示される「加盟店名」は以下のとおりです

※画面は予告なく変更される場合があります。

※EMV 3-Dセキュアは追加認証なしの場合もあります。

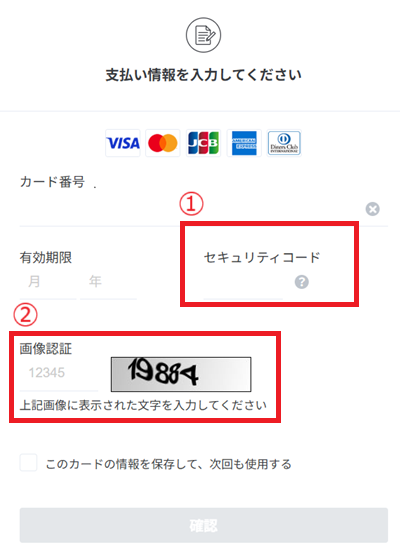

画面イメージ

※画面は予告なく変更される場合があります。

画面表示項目

| No | 項目名 | 説明 |

|---|---|---|

| 1 | セキュリティ コード(CVV2) | セキュリティコードは、クレジットカード現物を確認するためのセキュリティ機能です。 クレジットカードにセキュリティコードが記載されているため、スキミングなどで クレジットカード情報を 入手した第三者による不正利用の防止に有効です。 ※API型は、セキュリティコードの申込みをした場合でも、セキュリティコードの 連携は任意となります。連携しない場合は、セキュリティコードの認証なしで決済が行われます。 ※リンク型API型と併用の場合、一部の携帯電話の機種によっては利用できないことがあります。 |

| 2 | 名義人 (ローマ字) | 本人認証時の必須項目となります。 また、その他必須項目は、カード利用者決済情報トークンでご連携が必要となります。 EMV 3-Dセキュア認証システムをご参照ください。 |

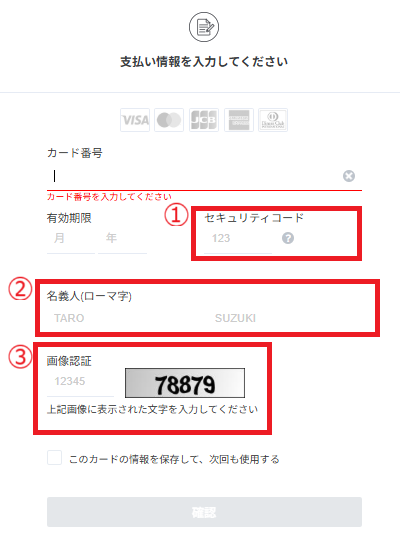

※画面は予告なく変更される場合があります。

画面表示項目

| No | 項目名 | 説明 |

|---|---|---|

| 1 | セキュリティ コード(CVV2) | セキュリティコードは、クレジットカード現物を確認するためのセキュリティ機能です。 クレジットカードにセキュリティコードが記載されているため、スキミングなどで クレジットカード情報を 入手した第三者による不正利用の防止に有効です。 ※API型は、セキュリティコードの申込みをした場合でも、セキュリティコードの 連携は任意となります。連携しない場合は、セキュリティコードの認証なしで決済が行われます。 ※リンク型API型と併用の場合、一部の携帯電話の機種によっては利用できないことがあります。 |

| 2 | 名義人 (ローマ字) | 本人認証時の必須項目となります。 また、その他必須項目は、カード利用者決済情報トークンでご連携が必要となります。 EMV 3-Dセキュア認証システムをご参照ください。 |

| 3 | 画像認証 | 画像認証は、システムではなく人間が操作していることを確認するための機能です。 画像の読み取りをシステムで自動化することは難しいため、プログラムによる 無差別アタック防止に有効です。 |

※こちらの画面は、最新画面Verで提供となります

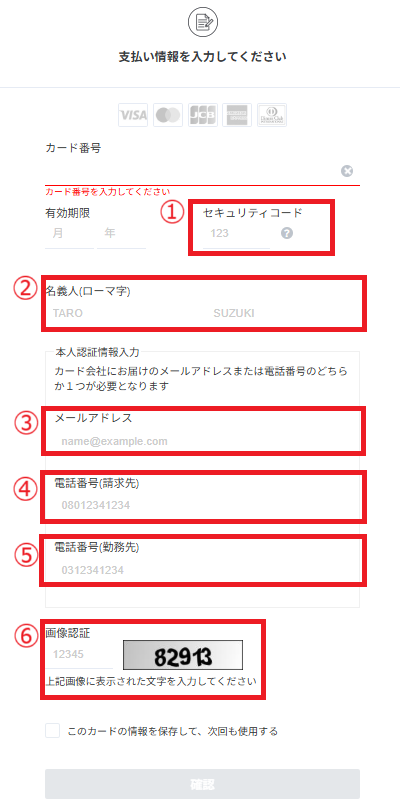

※画面は予告なく変更される場合があります。

画面表示項目

| No | 項目名 | 説明 |

|---|---|---|

| 1 | セキュリティ コード(CVV2) | セキュリティコードは、クレジットカード現物を確認するためのセキュリティ機能です。 クレジットカードにセキュリティコードが記載されているため、スキミングなどで クレジットカード情報を 入手した第三者による不正利用の防止に有効です。 ※API型は、セキュリティコードの申込みをした場合でも、セキュリティコードの 連携は任意となります。連携しない場合は、セキュリティコードの認証なしで決済が行われます。 ※リンク型API型と併用の場合、一部の携帯電話の機種によっては利用できないことがあります。 |

| 2 | 名義人 (ローマ字) | 本人認証時の必須項目となります。 |

| 3 | メールアドレス | 本人認証時の必須項目となります。 3項目のうち、どれか1つが必須で必要となります。 |

| 4 | 電話番号 (請求先) | |

| 5 | 電話番号 (勤務先) | |

| 6 | 画像認証 | 画像認証は、システムではなく人間が操作していることを確認するための機能です。 画像の読み取りをシステムで自動化することは難しいため、プログラムによる 無差別アタック防止に有効です。 |

※こちらの画面は、最新画面Verで提供となります

サービス仕様

基本仕様

利用可能な課金方式と課金方式別の基本仕様は以下のとおりです。決済管理ツールで行う売上確定や取消などの各種処理期間は、決済管理ツールに従います。

課金方式

| 都度課金 | ○ |

|---|---|

| 継続課金(簡易) | ○ |

| 継続課金(定期・従量) | × |

基本仕様

| 課金方式 | 項目 | 仕様 | |

|---|---|---|---|

| 都度課金 | 売上方式 | 自動売上 | ○ |

| 指定売上 | ○ | ||

| 売上確定期限 | 自動売上の場合:売上確定不要 指定売上の場合:購入要求処理日を含めて45日後まで(目安)※1 | ||

| 取消可能期間 | 自動売上の場合:取消機能無し 指定売上の場合:購入要求処理日を含めて45日後まで(目安)※1 | ||

| 返金可能期間 | 購入要求処理日を含めて6ヵ月後まで | ||

| 再与信可能期間 | 元となるトランザクションから6ヵ月以内 | ||

| 継続課金 (簡易) | 売上方式 | 自動売上 | ○ |

| 指定売上 | × | ||

| 継続課金処理(与信) | 初月:加盟店にて課金処理を実施 2ヵ月目以降:不要 | ||

| 売上処理日 | 毎月第1営業日に課金処理 | ||

| 課金処理不可通知日 | 毎月第1営業日から順次返却 | ||

| 返金可能期間 | 購入要求処理日を含めて6ヵ月後まで | ||

| 選択機能 | 初月有料/無料 のオプションが選択可 | ||

また、一部国際ブランドでは通販・電子取引において、与信を取得した日から、カード会社に売上データが届くまでに、7日を超過した場合、請求遅延として、カード会社がチャージバックすることができるというルールがあります。ただし、これらの売上すべてがチャージバックになるわけではなく、カード名義人からの利用否認の申し出など、何らかの問題が発生した取引がブランドルールに該当した場合が対象となります。

対応デバイス

利用可能なデバイスは以下のとおりです。

| デバイス | 利用可否 | 備考 |

|---|---|---|

| PC | ○ | – |

| スマートフォン | ○ | 画像認証を利用する場合、画像認証非対応の一部スマートフォンについては、 決済ができなくなりますのでご注意ください。 |

| 携帯 | – |

提供機能一覧

以下の機能を提供しています。決済管理ツールの機能は、主な機能のみを記載しています。詳しくは決済管理ツールマニュアルにて確認ください。

| 課金方式/ 売上方式 | 提供機能 | リンク型 | API型 | 決済管理ツール |

|---|---|---|---|---|

| 都度課金/ 自動売上 | 購入 | ○ | ○ | – |

| 返金 | – | ○ | ○ | |

| 決済結果参照 | ○ | – | ||

| 都度課金/ 指定売上 | 購入 | ○ | ○ | – |

| 売上 | – | ○ | ○ | |

| 部分売上 | – | ○ | ○ | |

| 取消 | – | ○ | ○ | |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○ | ○ | |

| 再与信 | – | ○ | – | |

| 決済結果参照 | – | ○ | – | |

| 継続課金 (簡易) | 購入 | ○ | ○ | – |

| 返金 | – | – | 〇 | |

| 決済結果参照 | – | ○※1 | – | |

| 継続課金(簡易)解約 | ○ | ○ | ○ | |

| 継続課金(簡易)解約通知 | ○ | ○ | – | |

| その他 | クレジットカード情報登録 | ○ | ○ | – |

| クレジットカード情報更新 | ○ | ○ | – | |

| クレジットカード情報削除 | ○ | ○ | ○※2 | |

| クレジットカード情報参照 | – | ○ | ○ |

※2:無効化ボタンで実行できます。

クレジットカード決済では、提供機能に加え、以下のサービス機能を提供しています。

| サービス機能 | リンク型 | API型 |

|---|---|---|

| クレジットカード情報お預かりサービス | ○ | ○ |

| クレジットカード洗替サービス(自動洗替) | ○ | ○ |

| 本人認証サービス EMV 3-Dセキュア | ○ | ○ |

| セキュリティコード(CVV2) | ○ | ○ |

| 画像認証 | ○ | – |

| 永久トークン機能 | – | ○ |

| AI不正検知 | 〇 | 〇 |

各サービス機能の詳細は以下のとおりです。

※本人認証サービス、セキュリティコード(CVV2)、画像認証の詳細は、エンドユーザー向け決済時認証方法を参照ください。

《クレジットカード情報お預かりサービス》

エンドユーザーが入力したクレジットカード番号や本人認証項目をお預かりするサービスです。なお、継続課金(簡易)、クレジットカード洗替サービス(自動洗替)利用の場合は必須となります。以下は、利用例です。

- エンドユーザーに事前登録をさせたい場合

再訪エンドユーザー向けに入力利便向上を図りたい場合※プリペイドカードやデビットカードなど一部カードは登録できない場合があります。

《クレジットカード洗替サービス(自動洗替)》

毎月、当社に保管しているクレジットカードの有効性をクレジットカード会社へ確認するサービスです。なお、一部のカード会社については、クレジットカード情報の更新も行われます。利用の目安は、会員数2万件以上です。

《ワンタイムトークンを利用した決済とは》

エンドユーザーが入力したクレジットカード情報を、ワンタイムのトークン(別の文字列)に変換したうえで決済を行うことです。加盟店は、当社が提供するJavaScriptを加盟店サイトに組み込むことで、クレジットカード情報を保持せずに決済できます。また、加盟店サイト上で決済が完結するため、決済画面デザインを自由に作成することが可能です。なお、ワンタイムトークンは、クレジットカード番号とは全く異なる文字列での返却となります。

※ワンタイムトークン取得APIで情報を取得後、当該ワンタイムトークンを利用して連携・処理する必要があります。詳細については、ワンタイムトークンシステムを参照ください。

《永久トークン機能》

エンドユーザーが入力したクレジットカード番号を、永久的に変わらないトークン(別の文字列)に変換したうえで決済を行うことです。加盟店は、ワンタイムトークンを利用して永久トークンを返却、もしくは、永久トークン非保持化サービスのタブレットを利用することで、クレジットカード情報を保持せずに決済できます。また、永久トークン機能はクレジットカード番号と同じ桁数に変換するため、加盟店システムをそのまま利用可能です。なお、永久トークン機能は、元のクレジットカード番号への変換が不可能となっている全く別の文字列となります。

ワンタイムトークン、永久トークンを利用した決済の流れは以下のとおりです。

ワンタイムトークンのAPI利用の流れは以下のとおりです。

- ワンタイムトークン取得APIにてワンタイムトークン情報取得

- APIにてワンタイムトークン情報の連携および決済処理(与信・顧客登録・継続課金など)

- 後続処理系のAPIにて後続処理(コミット・売上確定・返金など)

永久トークン機能のAPI利用の流れは以下のとおりです。

- ワンタイムトークン取得APIにてワンタイムトークン情報取得

永久トークン非保持化サービスでタブレットを利用する場合は、タブレットで永久トークン取得 - ワンタイムトークン利用・永久トークン返却APIを利用して決済処理(決済要求、情報登録など)

タブレットで永久トークンを取得した場合は、永久トークンを利用し決済処理(決済要求、情報登録など) - 後続処理系のAPIにて後続処理(確定要求・売上要求・返金など)

《AI不正検知》

決済情報と機械学習で不正利用を検知するサービスです。

年間数億件を超える決済データによって、あらゆる不正パターンを機械学習しモデルを作成することで、人間では見分けがつかない不正パターンとの類似性をスコアとしてリアルタイムに算出することが可能です。

リンク型を利用の場合は自動的にスコアを算出しますが、API型を利用の場合は当社が提供するJavaScriptを加盟店サイトに組み込むことで利用できます。

※リンク型の利用開始時期によっては、AI不正検知に対応している画面へ切り替えが必要です。

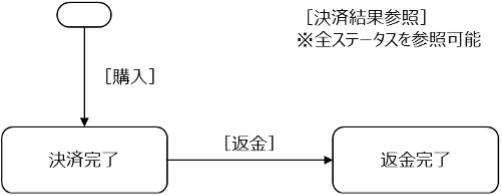

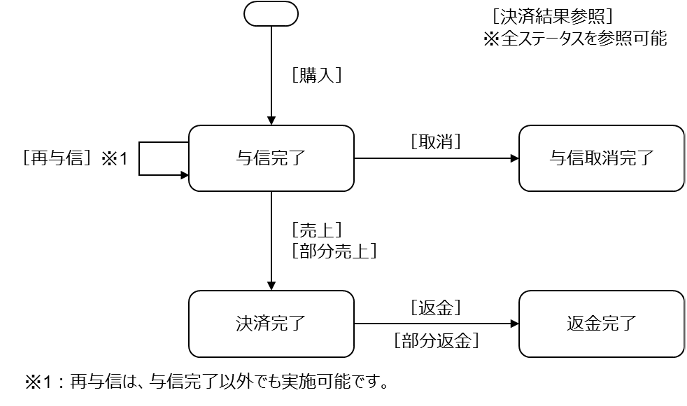

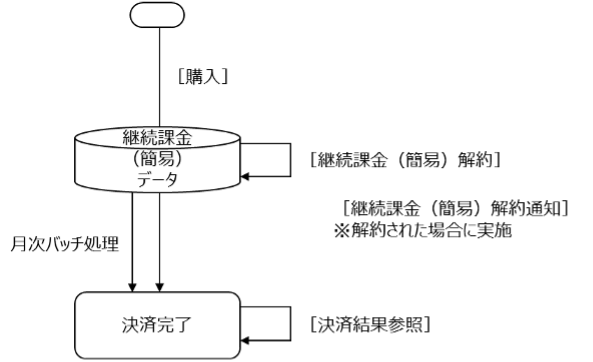

決済ステータス遷移

提供している各機能を実施することで、以下のように決済のステータスが遷移します。各機能の実施方法については、「リンク型 IF仕様」、「API型 IF仕様」、および「SBPS決済管理ツール機能マニュアル」をご参照ください。

《都度課金/自動売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | (ワンタイムトークン取得要求/ 永久トークン非保持化サービスのタブレットを利用して永久トークンを取得) 決済要求 (ワンタイムトークン利用)ST01-00131-101 (永久トークン利用)ST11-00111-101 (ワンタイムトークン利用・永久トークン返却) ST11-00131-101 確定要求※1 ST02-00101-101 | – |

| 返金 | – | 取消返金要求 ST02-00303-101 | 請求情報画面 「カード返金」 |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-101 | – |

《都度課金/指定売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | (ワンタイムトークン取得要求/ 永久トークン非保持化サービスのタブレットを利用して永久トークンを取得) 決済要求 (ワンタイムトークン利用) ST01-00131-101 (永久トークン利用) ST11-00111-101 (ワンタイムトークン利用・永久トークン返却) ST11-00131-101 確定要求※1 ST02-00101-101 | – |

| 売上 | – | 売上要求 ST02-00201-101 | 請求情報画面 「売上」 または カード一括売上 処理画面「一括登録」 |

| 部分売上 | – | 売上要求 ST02-00201-101 | 請求情報画面 「部分売上」 |

| 取消 | – | 取消返金要求 ST02-00303-101 | 請求情報画面 「与信取消」 |

| 返金 | – | 取消返金要求 ST02-00303-101 | 請求情報画面 「カード返金」 |

| 部分返金 | – | 部分返金要求 ST02-00307-101 | 請求情報画面 「カード部分返金」 |

| 再与信 | – | 再与信要求 (ワンタイムトークン利用) ST01-00133-101 | – |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-101 | – |

《継続課金(簡易)の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | (ワンタイムトークン取得要求) 継続課金(簡易)購入要求 (ワンタイムトークン利用) ST01-00132-101 確定要求※1 ST02-00101-101 | – |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-101 | |

| 継続課金(簡易)解約 | 購入要求 A01-1 | 継続課金(簡易)解約要求 ST02-00302-101 | 継続課金(簡易) ユーザー情報画面 「解約する」 |

| 継続課金(簡易)解約通知 | 購入結果CGI A02-1 | 継続課金(簡易)解約通知 NT01-00108-101 | – |

注意事項

デビットカード/プリペイドカード情報

VISA, MasterCard, JCBなどブランドがついたデビットカード、プリペイドカードは、通常のクレジットカードと同様に利用できます。

但し、デビットカード、プリペイドカードの場合、その特性により、以下の注意点があります。

- 与信と同時に利用額が引き落とされるため、金額変更(一旦キャンセル後に再与信)などにより、一時的に二重課金になる場合があります。

- 一定期間(クレジットカード発行会社により異なります)内に売上処理がされなければ自動的に返金されます。なお、売上処理は自動返金後も可能ですが、残高がない場合はエラーとなります。

不正利用調査およびチャージバック

エンドユーザーから商品不備や利用覚え無しなどの申し出や、第三者による不正利用の疑いなどにより、各クレジットカード会社から不正利用調査およびチャージバック(債権買取拒否)が発生する場合があります。当社が各クレジットカード会社から連絡を受けた場合、速やかに加盟店に状況を連絡しますので、連絡内容に沿って対応ください。なお、チャージバックが確定した場合、当該売上金額は精算対象外となり、加盟店負担となります。詳しくは、申込時に提供する重要事項説明書を参照ください。

継続課金(簡易)について

永久トークンで継続課金(簡易)を実施する場合、あらかじめ、クレジットカード情報登録要求(永久トークン利用)を行う必要があります。

取消返金要求時にエラーが発生した場合

取消期限内の「カード取消」(取消返金要求)で与信エラーが発生した場合、SBPS加盟店サポートまでご連絡ください。

仕様について

クレジットカード決済は、クレジットカード会社が提供するサービスをオンライン決済ASPに組み込み提供しています。クレジットカード会社にて仕様変更や経済条件の変更等を行った場合は、それに伴い当社が提供するクレジットカード決済の仕様も変更となる場合がありますのでご了承ください。

メンテナンス等によるサービス停止

オンライン決済ASPは、不定期にメンテナンスを行います。メンテナンスによるサービス停止がある場合はあらかじめ通知のうえ、サービス停止します。1週間前までに通知することを基本としています。ただし、緊急メンテナンスによる場合はその限りではありません。

また、当社のシステム以外で、各クレジットカード会社や各クレジットカード会社提携先等のシステムメンテナンスや不具合によるサービス停止が発生した場合、状況がわかり次第、速やかに加盟店に通知のうえ、原因究明をします。原因判明でき次第、加盟店に通知するようにしますが、当社に起因しない場合、原因判明に時間がかかる場合があることを予めご了承ください。

補足情報

補足情報はありません。