au Pay (Online Payment)

The au PAY (Online Payment) is a payment method provided by KDDI. The service enables to use au PAY for payments of online shopping.

For more information on the au PAY (Online Payment) Service, refer to the following website. Note that the URL may change.

<au PAY (Online Payment)>

https://aupay.wallet.auone.jp/

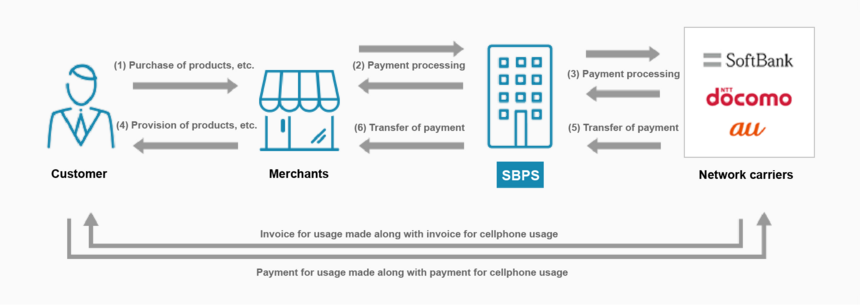

Service Diagram

Main Features

- Even if the end user is not an au user, this service is available if the user obtains an au ID and can use au PAY or an au PAY prepaid card (former au WALLET prepaid card).

- Ponta points are gotten in accordance with the use amount.

- The au PAY (Online Payment) Service has the auto-charge function that enables end users to select from the following charge methods.

| Charge method | Content |

|---|---|

| Real-time charge | If the au PAY balance is insufficient upon a payment, the shortfall is automatically charged. |

| Fixed amount charge | If the au PAY balance decreases below the specified amount, the specified amount is automatically charged. |

Usage Information For End Users

Please refer to the service website for details on the purchasing procedure.

For end-user usage information, please refer to the FAQ (Payment /System Specifications > au PAY (Online Payment)) or the page of each Financial institution.

Service Specifications

Basic Specifications

The available billing systems and billing system-specific basic specifications are as follows. Each period of time for processing settlement, cancellation, and others performed by the payment administration tool is based on the tool.

Billing Methods

| One-time charge | ○ |

|---|---|

| Recurring charge (simple) | × |

| Recurring charge (based on term or usage rate) | × |

Basic Specifications

| Billing method | Field | Specifications | |

|---|---|---|---|

| One-time charge | Close authorization settlement | Automated sales | ○ |

| Specified sales | ○ | ||

| Period for settlement | Auto close authorization settlement: settlement is not necessary. Specified close authorization settlement: Until the 90th day including the date of purchase request process.※1 | ||

| Period for cancellation | Auto close authorization settlement: cancellation function not available. Specified close authorization settlement: Until the 90th day including the date of purchase request process. | ||

| Period for refund | Until the last day of the month after next including the date of settlement process. | ||

Supported devices

The available devices are as follows.

| Device | Availability | Remarks |

|---|---|---|

| PC | ○ | – |

| Smartphone | ○ | – |

| Mobile | × | – |

List of Provided Functions

The following functions are provided. As for the payment administration tool, only the main functions are listed. For details, see the Payment Administration Tool Manual.

| Billing system/Close authorization settlement | Provided functions | Link Type | API Type | Payment management tool |

|---|---|---|---|---|

| One-time billing/Auto close authorization settlement | Purchase | ○ | – | – |

| Refund | – | ○ | ○ | |

| Partial Refund | – | ○※1※2 | ○※1※2 | |

| One-time billing/Specified close authorization capture | Purchase | ○ | – | – |

| Settlement | – | ○ | ○ | |

| Partial Settlement | – | ○ | ○ | |

| Cancellation | – | ○ | ○ | |

| Refund | – | ○ | ○ | |

| Partial Refund | – | ○※1※2 | ○※1※2 |

*2: The partial refund can be used only once.

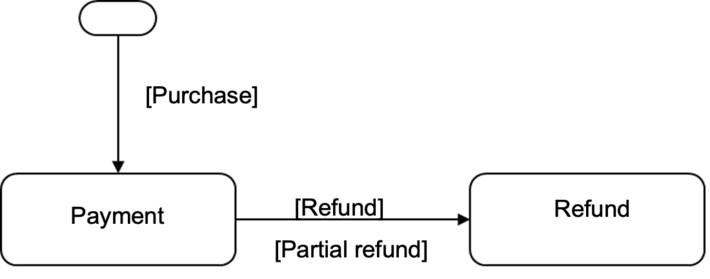

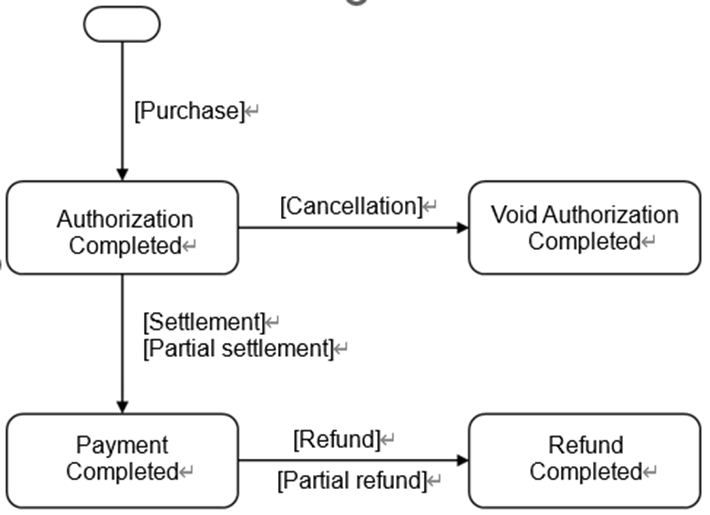

Payment Status Transition

By implementing each of the functions provided, the status of the Payment will Transition as follows. For details on how to implement each function, refer to the Link Type IF specification, the API type IF specification, and the SBPS Admin portal / Payment management tool Function Manual.

<<One-time billing/Auto close authorization settlement >>

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Refund | – | Cancel/Refund Request ST02-00303-406 | Billing Information Screen "Refund" |

| Partial Refund | – | Cancel/Refund Request ST02-00303-406 | Billing Information Screen "Partial refund" |

<<One-time billing/Specified close authorization settlement >>

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Settlement | – | Sales request ST02-00201-406 | Billing Information Screen "Settlement" |

| Partial Settlement | – | Sales request ST02-00201-406 | Billing Information Screen "Partial Settlement" |

| Cancellation | – | Cancel/Refund Request ST02-00303-406 | Billing Information Screen "Cancellation" |

| Refund | – | Cancel/Refund Request ST02-00303-406 | Billing Information Screen "Refund" |

| Partial Refund | – | Cancel/Refund Request ST02-00303-406 | Billing Information Screen "Partial refund" |

Cautions

Behaviors depending on end user status

An error is returned and the process cannot be carried out if the end user using the service is in one of the following states (in a state where no process can be carried out) when the settlement request process, cancel/refund process, etc., is carried out. In such a case, note that billing and refunds cannot be carried out.

* If the process fails, the Merchant shall consider dealing with the end user.

- The end user has configured the setting to suspend "au PAY".

- The user has specified "Fully restrict use of au Kantan Kessai Service" for "au Kantan Kessai Service use restriction settings".

Differences of functions when au PAY (Online Payment) is used via SBPS

When using au PAY (Online Payment), SBPS will incorporate the various interface specifications of au PAY (Online Payment) and the differences in specifications for each additional payment method into SBPS’s standard payment function. Therefore, Merchants can connect with the payment system and manage the payment processing without worrying about the payment methods actually used by the end users.

* Note that some restrictions are imposed on some functions.

- Payment management tool provided by KDDI

The payment management tool provided by KDDI cannot be used. Use the payment administration tool provided by SBPS to manage the payment information. - OpenID sharing

SBPS links the "Customer ID" shared through the payment ASP interface provided by SBPS and the OpenID linked with the au ID and manages them to enable to omit the login screen for the second and later payments with au PAY (Online Payment). Note that the customer ID to be shared shall be unique among end users.

Submission of Merchant's logo

Be sure to submit the following information to SBPS to show the Merchant's service logo in "au PAY Can Be Used at These Shops" in the KDDI's au PAY website.

If any of the following information changes, please be sure to contact us. Your information will be shared with KDDI through SBPS.

Note that KDDI decides whether or not to show your service logo.

| No. | Information to be provided | Content |

|---|---|---|

| 1 | Logo data | The requirements are as follows:

|

| 2 | Transition destination URL | The URL to which the user will be redirected after clicking the logo. |

| 3 | Service's official name | This is displayed when the logo is displayed in KDDI's website. |

Test by Merchant

In some cases, the Merchant's special app and external browser may control the start of external apps causing the au PAY app to fail to start.

To avoid this behavior, we recommend that the Merchant tests in advance that the au PAY app properly starts and the control is given to the au PAY app properly.

As for a recommended test method, SBPS sales representative will provide a material separately.

Unauthorized Usage Investigations and Chargebacks

As a result of a complaint from the end user due to defective items or use that he/she is not aware of, or doubts about unauthorized use by a third party, KDDI may conduct unauthorized usage investigation or a chargeback (refusal of factoring) may be made. Upon receipt of notification from KDDI, SBPS will promptly report it to the relevant Merchant. Then, the Merchant is encouraged to take action in accordance with the notification. Note that if the charge back is fixed, the relevant sales amount will be excluded from settlement and be borne by the Merchant. For details, see the statement of material importance submitted when applying for the service.

Note that if the credit card payment is used as an additional payment method, a notification may be sent directly from the credit card company or a payment agency company subcontracting with KDDI bypassing SBPS.

Specifications

au PAY (Online Payment) is provided by incorporating the service provided by KDDI into the Online Payment ASP Service provided by SBPS. Note that if KDDI makes a change to the specifications or economic requirements, the specifications of au PAY (Online Payment) provided by SBPS may also change.

Service Suspension Due to Maintenance, etc.

Maintenance of the Online Payment ASP Service is performed on an irregular basis. Any service suspension due to maintenance will be notified in advance. As a rule, such a notification is made one week before the suspension. However, this may not be the case in the event of emergency maintenance.

If the service is suspended due to maintenance or the failure of KDDI or its partner systems that are not SBPS systems, SBPS will promptly report it to Merchants as soon as we become aware of the situation and then find out the cause. Note that although SBPS will report to Merchants as soon as we find out the cause, it may take time to determine the cause if the problem is not attributable to us.

Supplementary Information

No supplementary information available.