What is Recruit Kantan Payment?

Recruit Kantan Payment is the payment methods provided by Recruit. You can use the payment information registered in your Recruit ID to pay for Item, etc.

The following methods of payment are available for end users:

Credit card payments

How to pay with a pre-registered credit card

<Online convenience store payment>

How to pay at the convenience store selected during Payment

Available convenience stores: Seven-Eleven / FamilyMart / Lawson / Ministop /Daily Yamazaki/ Seicomart

※ Convenience stores that are not available for Review due to vetting cannot be used. Convenience stores that are not available for Review due to vetting cannot be used.

Paying with points

How to pay with your points

*Only the payment method designated by merchant at the time of implementation can be used. In addition, the payment method (including convenience store chains for WEB convenience store payments) cannot be changed after Payment completed.

For more information on Recruit Kantan Payment, please refer to the following site. URLs are subject to change.

〈Recruit Kantan Payment〉

https://settle.point.recruit.co.jp/

Service Diagram

Main Features

- You can easily shop with just your Recruit ID and password.

- You can make payments using the credit card registered to your Recruit ID or your accumulated points.

- You can earn points based on the amount you spend.

End-user Instructions

Please refer to the service website for details on the purchasing procedure.

For end-user usage information, please refer to the FAQ (Payment /System Specifications > Recruit Kantan Payment) or the page of each Financial institution.

Service Specifications

Basic Specifications

The available billing systems and billing system-specific basic specifications are as follows. Each period of time for processing settlement, cancellation, and others performed by the payment administration tool is based on the tool.

Billing Methods

| One-time charge | ○ |

|---|---|

| Recurring charge (simple) | ○ |

| Recurring charge (based on term or usage rate) | ○ |

Basic Specifications

| Billing method | Field | Specifications | |

|---|---|---|---|

| One-time charge | Close authorization settlement | Automated sales | ○ |

| Specified sales | ○ | ||

| Settlement confirmation deadline (Authorization deadline) | Auto close authorization settlement: settlement is not necessary. For designated Settlement: up to 30 days after Purchase request processing date※1 | ||

| Period for cancellation | Auto close authorization settlement: cancellation function not available. In the case of designated Settlement: No cancellation deadline | ||

| Period for refund | By the last day of the next month including the capture processing date※2 | ||

| Re-Authorization deadline | Up to 30 days after the Authorization Purchase request processing date※1 | ||

| Convenience store payment deadline | The date and time that merchant reports at the time of application, within 29 days from the day after Payment date※3 | ||

| Recurring charge (simple) | Close authorization settlement | Automated sales | ○ |

| Specified sales | × | ||

| Recurring billing processing (authorization) | First month: Billing processing is performed by the Merchant. Second month onward: Not necessary. | ||

| Date of settlement process | SBPS automatically bills on the first day of each month. | ||

| Date of notification of billing processing not possible | Returned starting from the second day of each month in order. | ||

| Period for refund | Not refundable. * If refund is necessary, the Merchant shall handle it. | ||

| option | Whether the first month is charged or not and whether cancellation in the first month is billed or not can be selected as options. | ||

| Recurring charge (based on term or usage rate) | Close authorization settlement | Automated sales | × |

| Specified sales | ○ | ||

| Recurring billing processing (authorization) | The billing processing is performed by the Merchant * SBPS does not perform the billing processing. | ||

| Period for settlement | Purchase request processing date, or in 30 days including the recurring billing (fixed term/pay-as-you-go) purchase request processing date※1 | ||

| Date of notification of billing processing not possible | None | ||

| Period for cancellation | Purchase request processing date, or by the last day of the next month of recurring billing (fixed term/pay-as-you-go) purchase request processing | ||

| Period for refund | By the last day of the next month including the capture processing date | ||

| Expiration date of the recurring billing from the date of last payment process | 24 months | ||

*2: WEB convenience store payment is not possible Refund (however, points can be Refund when used together). For details, please refer to the "Notes" section about the Refund of WEB convenience store payment.

*3: It is also possible to specify the payment deadline for each Payment. For details, please refer to the individual specifications of "Link Type Purchase request".

Supported devices

The available devices are as follows.

| Device | Availability | Remarks |

|---|---|---|

| PC | ○ | – |

| Smartphone | ○ | – |

| Mobile | × | – |

List of Provided Functions

The following functions are provided. As for the payment administration tool, only the main functions are listed. For details, see the Payment Administration Tool Manual.

| Billing system/Close authorization settlement | Provided functions | Link Type | API Type | Payment management tool |

|---|---|---|---|---|

| One-time billing/Auto close authorization settlement | Purchase | ○ | – | – |

| Refund※1 | – | ○ | ○ | |

| Partial Refund※1 | – | ○ | ○ | |

| Multiple Refunds※1 | – | ○ | ○ | |

| Deposit notification※2 | ○ | – | – | |

| Overdue payment cancellation notification※2 | ○ | – | – | |

| One-time billing/Specified close authorization capture | Purchase | ○ | – | – |

| Settlement※1 | – | ○ | ○ | |

| Partial Settlement※1 | – | ○ | ○ | |

| Cancellation※1 | – | ○ | ○ | |

| Refund※1 | – | ○ | ○ | |

| Partial Refund※1 | – | ○ | ○ | |

| Multiple Refunds※1 | – | ○ | ○ | |

| Re-obtained authorization※1 | – | ○ | – | |

| Deposit notification※2 | ○ | – | – | |

| Overdue payment cancellation notification※2 | ○ | – | – | |

| Recurring charge (simple)※1 | Purchase | ○ | – | – |

| Cancellation of recurring billing (simplified) | ○ | ○ | ○ | |

| Recurring billing (simplified) cancellation notification | ○ | – | – | |

| Recurring charge (based on term or usage rate)※1 | Purchase | ○ | – | – |

| Settlement | – | ○ | ○ | |

| Partial Settlement | – | ○ | ○ | |

| Cancellation | – | ○ | ○ | |

| Refund | – | ○ | ○ | |

| Partial Refund | – | ○ | ○ | |

| Multiple Refunds | – | ○ | ○ | |

| Recurring Billing (Fixed Term/Pay as You Go) Request | ○ | – | – | |

| Recurring Billing (Fixed Term/Pay as You Go) Purchase | – | ○ | ○ | |

| Recurring Billing (Fixed Term/Pay as You Go) Unsubscribing | ○ | ○ | ○ |

※2: This function is only available for online convenience store payments.

<<Deposit notification function>>

This function is only available for WEB convenience store payment, and notifies merchant of the completion (Credit notification) after the end user has completed the payment at the convenience store. The notification timing after Credit at the store is as follows.

※ Even after Credit has been notified, the convenience store may cancel Credit. If this happens, you will be contacted by email from Recruit.

| Convenience store | Timing of Credit notification | |

|---|---|---|

| Seven-Eleven | After a few minutes | |

| FamilyMart | After about 5 to 20 minutes | |

| LAWSON | After about 20 to 30 minutes | |

| MINISTOP | After about 20 to 30 minutes | |

| Daily Yamazaki | After about 5 to 20 minutes | |

| Seicomart | A few minutes to an hour later | |

<<Overdue payment cancellation notification function>>

This function is only available for online convenience store payments, and notifies merchant of cancellation due to the expiration of the payment deadline (payment deadline expiration cancellation notice) for invoices that have passed the set payment deadline.

Batch processing will be performed once a day on business days and at times determined by SBPS and Recruit. In the event of a batch processing failure, investigation and response will begin from the opening time of the operating day.

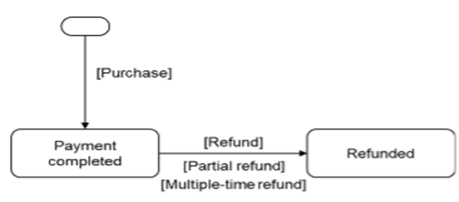

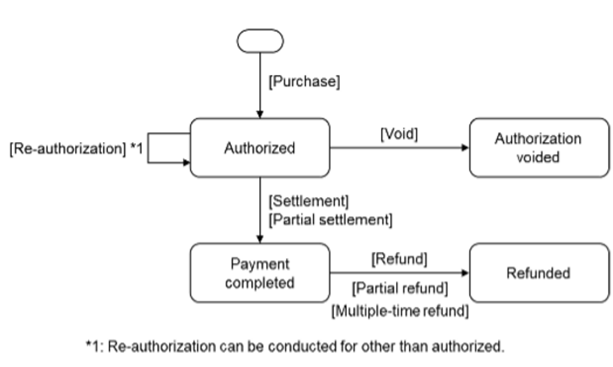

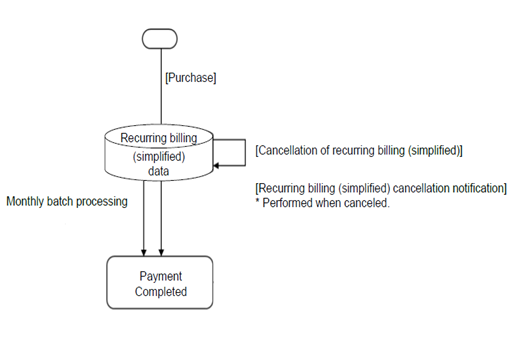

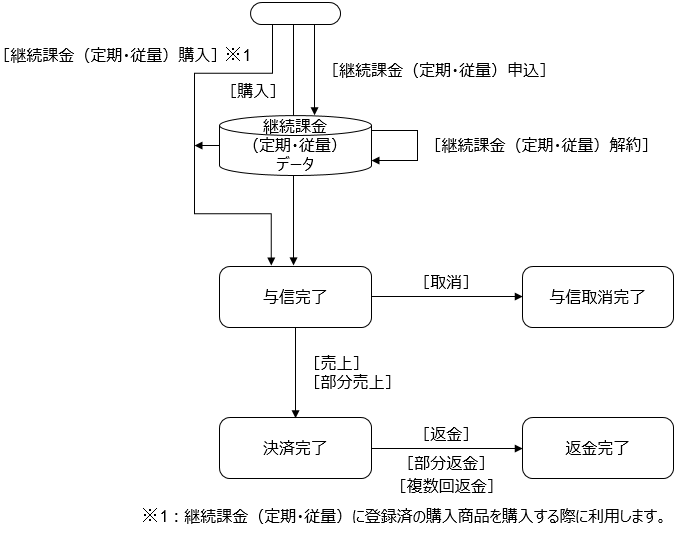

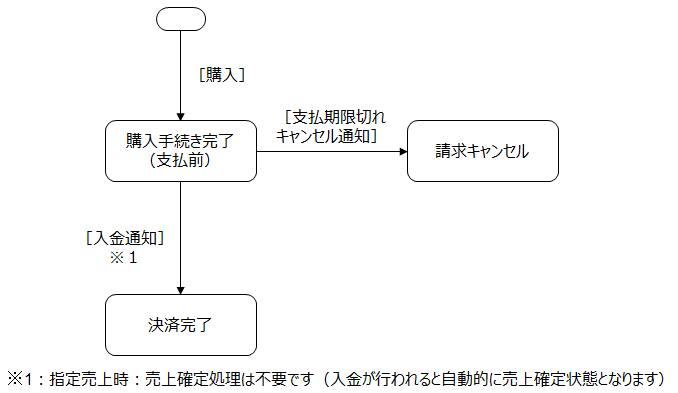

Payment Status Transition

By implementing each of the functions provided, the status of the Payment will Transition as follows. For details on how to implement each function, refer to the Link Type IF specification, the API type IF specification, and the SBPS Admin portal / Payment management tool Function Manual.

《Credit card payment: One-time billing / Auto Close Authorization Capture》

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Refund" |

| Partial Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Partial refund" |

| Multiple Refunds | – | Multiple Refund requests ST02-00308-309 | Billing Information Screen "Multiple Refund" |

《Credit card payment: One-time billing / Designated Settlement》

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Settlement | – | Sales request ST02-00202-309 | Billing Information Screen "Settlement" |

| Partial Settlement | – | Sales request ST02-00202-309 | Billing Information Screen "Partial Settlement" |

| Cancellation | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Cancellation" |

| Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Refund" |

| Partial Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Partial refund" |

| Multiple Refunds | – | Multiple Refund requests ST02-00308-309 | Billing Information Screen "Multiple Refund" |

| Re-obtained authorization | – | Re-obtained authorization request ST03-00103-309 | – |

《Credit card payment: Recurring billing (simplified)》

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Cancellation of recurring billing (simplified) | Purchase Request A01-1 | Recurring charge (simple) Cancellation request ST02-00302-309 | Recurring charge (simple) User Information Screen "Cancel" |

| Recurring billing (simplified) cancellation notification | Purchase Result CGI A02-1 | – | – |

《Credit card payment: Recurring billing(fixed term/pay-as-you-go)》

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Settlement | – | Sales request ST02-00202-309 | Billing Information Screen "Settlement" |

| Partial Settlement | – | Sales request ST02-00202-309 | Billing Information Screen "Settlement" |

| Cancellation | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Cancellation" |

| Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Refund" |

| Partial Refund | – | Cancel/Refund Request ST02-00306-309 | Billing Information Screen "Partial refund" |

| Multiple Refunds | – | Multiple Refund requests ST02-00308-309 | Billing Information Screen "Multiple Refund" |

| Recurring Billing (Fixed Term/Pay as You Go) Request | Recurring charge (based on term or usage rate) Application Request D01-1 | – | – |

| Recurring Billing (Fixed Term/Pay as You Go) Purchase | – | Recurring charge (based on term or usage rate) Purchase Request ST01-00104-309 | Recurring billing(fixed term/pay-as-you-go) User Information Screen "Purchase" |

| Recurring Billing (Fixed Term/Pay as You Go) Unsubscribing | Recurring charge (based on term or usage rate) Application Request D01-1 | Recurring charge (based on term or usage rate) Cancellation request ST02-00309-309 | Recurring charge (based on term or usage rate) User Information Screen "Cancellation" |

《WEB convenience store payment: One-time billing / Auto Close Authorization Capture Settlement・In the case of designated Settlement》

| Provided functions | Link Type Process name/Function ID | API Type Process name/Function ID | Payment management tool Screen name/Button name |

|---|---|---|---|

| Purchase | Purchase Request A01-1 | – | – |

| Deposit notification | Purchase Result CGI A02-1 | – | – |

| Overdue payment cancellation notification | Purchase Result CGI A02-1 | – | – |

Cautions

Debit/ Prepaid card usage

If an end user uses a debit card or Prepaid card to pay by credit card, there are some points to note:

- The amount will be debited from your account immediately upon Authorization.

- If there is a period of 30 days or more between the time of Authorization and the time of Settlement confirmation (the period varies depending on the card issuer), Authorization amount may be automatically Refund to the user's account.

- After Refund to the end user's account, Settlement confirmation at merchant may result in a chargeback to merchant if the account cannot be debited.

Introduction of WEB convenience store payment only

If you want to introduce only WEB convenience store payment, it is a condition for introduction that a payment methods other than Recruit Kantan Payment is introduced.

Stamp fee for WEB convenience store payment

If the Payment amount is 50,000 yen or more when using WEB convenience store payment, a separate stamp fee is required as stipulated by the Stamp Tax Act. The stamp fee will be offset against Item purchase price.

Required information when paying at a convenience store

After Payment completed, the end user will need the following information when making the payment at a convenience store:

※Payment procedures at convenience stores: https://settle.point.recruit.co.jp/contents/CVShelp.htm

| Convenience store | Required Information | Convenience store | Required Information |

|---|---|---|---|

| Seven-Eleven | Payment slip number | FamilyMart | Company Code Order Number |

| LAWSON | Acceptance number Confirmation number | MINISTOP | Acceptance number Confirmation number |

| Daily Yamazaki | On-line payment number | Seicomart | Acceptance number Phone number (the number entered at the time of Payment) |

Refund for online convenience store payments

When using online convenience store payments, Refund cannot be made after Credit at a convenience store. Therefore, if Refund is required, merchant must Refund amount directly to the end user. However, when using points in conjunction with Payment, the points used can be returned (returned to the end user) through Recruit. To return points, this is an offline process, so please contact SBPS Merchant Support. The process is as follows:

"WEB CVS Payment Refund and Return Point Flow"

1) merchant contacts SBPS Merchant Support

② SBPS Merchant Support will send the "Cancellation Request Form" to merchant

3) merchant must fill out a cancellation request form and submit it to SBPS Merchant Support

④SBPS requests cancellation from Recruit (requests points return)

⑤After the points are returned by Recruit, SBPS Merchant Support will contact merchant to complete the process.

※ We will inform you of the breakdown of combined payments (amount used for points and amount used at the convenience store online).

Refund for online convenience store purchases will be made to end users by merchant

Settlement Rules

It differs from other payment methods in some ways. Please note the following differences:

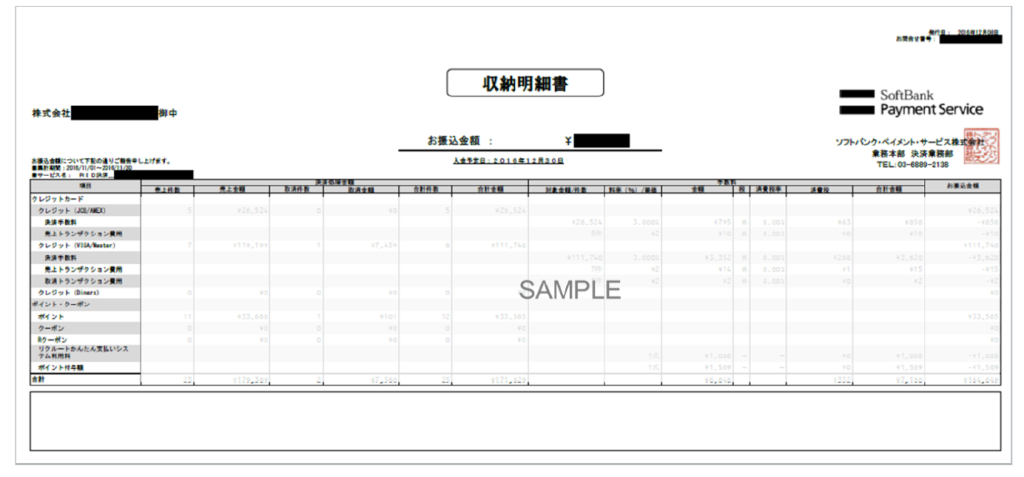

(1) About the detailed statement of collections

In addition to the regular payment statement, we will issue a detailed payment statement (detailed version) that describes each payment method of Recruit Kantan Payment and the actual amount of points used and awarded. Note that in other payment methods, the Credit amount will be shown on the regular receipt statement, but in the case of Recruit Kantan Payment, the Credit amount will also be shown on the detailed statement.

The cost items and a sample of the detailed collection statement are as follows:

<<Expense items in the detailed statement of collection>>>

| Expense items | Description | |

|---|---|---|

| Credit card WEB Convenience store | Payment fee | This is the fee for using each payment method. ※In the case of online convenience store payment, it will be displayed as transaction fee. |

| Payment service fee | Commission for using the Online Payment ASP Service. | |

| Transaction fee | A fee for the system processing. | |

| point | Payment service fee | This is our system fee for using points. |

| coupon | Payment service fee | This is our system fee for using the coupon. |

| R coupon | Payment service fee | This is our system fee for using R coupons. |

| Recruit Kantan Payment System Usage Fee | This is the fee for using points and R coupons. | |

| Points awarded | This is the fee for awarding points. | |

《Sample of detailed storage statement》

Points to note:

- In the case of a transfer from the Company to merchant, if multiple payment methods are used, Recruit Kantan Payment / Credit will be made separately from other payment methods (two Credit will be made on the payment day at the end of the month).

- The creditor-payer relationship regarding point redemption/grant, coupon usage fees, etc. will be between merchant and Recruit.

- If Refund occurs, Refund amount and Refund fee will be deducted from the payment for the month in which the refund occurred. The points used when purchasing the Item and the amount equivalent to the points awarded will also be Refund.

- The detailed statement of collections will be sent separately from the regular statement of collections, and will be sent by the 10th business day of the month following the month in which Settlement were confirmed. However, when using the online convenience store payment, only the detailed statement will be sent by the 21st of the following month.

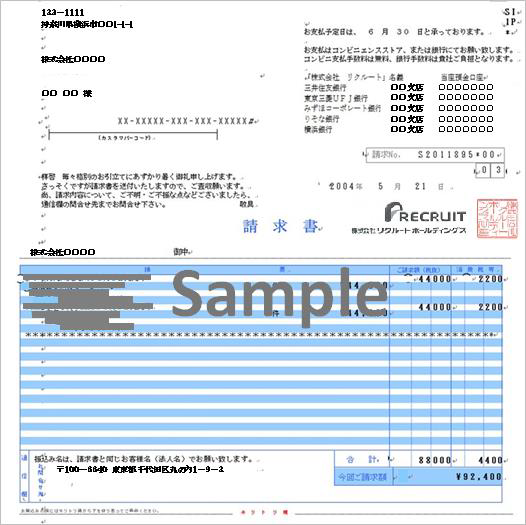

- In the event that the Payment fee cannot be deducted for each payment method and point settlement of each Recruit Kantan Payment method, we will issue an invoice by the last day of the month following the month in which Settlement is confirmed. Please pay by the end of the second month following the confirmed month (the end of the month following receipt of the invoice). If you are unable to pay by the specified date, Recruit will charge you for the system usage fee and the amount of points awarded. Please check the invoice with the sample below.

<Sample of invoice>

Unauthorized Usage Investigations and Chargebacks

In cases where an end user reports a defective Item or a transaction that they do not remember, or where they suspect a third party has made a fraudulent use, Recruit may investigate the fraudulent use and issue a chargeback (refusal to purchase the credit). If Recruit contacts us, we will promptly inform merchant of the situation, so please respond according to the information we receive. If a chargeback is confirmed, the Settlement amount will not be subject to settlement and will be borne by merchant. For more information, please refer to the Important Information Document provided at the time of application.

Please note that in the event of a chargeback, Recruit will be responsible for the amount equivalent to the Points exercised by the End User, and merchant will be responsible for the source of the Points awarded to the purchased Item. The amount Credit Card Payment will be contacted by the credit card company via our company.

Specifications

Recruit Kantan Payment provides the services provided by Recruit embedded in Online Payment ASP Service. Please note that if Recruit changes its specifications or economic conditions, the specifications of the Recruit Kantan Payment provided by the Company may also change accordingly.

Service Suspension Due to Maintenance, etc.

Maintenance of the Online Payment ASP Service is performed on an irregular basis. Any service suspension due to maintenance will be notified in advance. As a rule, such a notification is made 1 week before the suspension. However, this may not be the case in the event of emergency maintenance.

In addition, if a service outage occurs due to system maintenance or a malfunction of Recruit or a Recruit partner other than our system, we will notify merchant as soon as we become aware of the situation and investigate the cause. We will notify merchant as soon as the cause is identified, but please note that if the cause is not attributable to our company, it may take some time to identify the cause.

Supplementary Information

No supplementary information available.