越境パックとは

決済の種類と対象

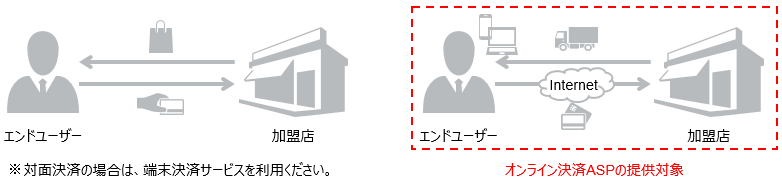

決済は「対面決済」と「非対面決済」の2種類に大別することができ、越境パックは、「非対面決済」に対する決済代行サービスを提供しています。

対面決済

エンドユーザーが実店舗に来店して、 商品等を購入する決済のことです。

例)百貨店、スーパーマーケット、飲食店など

非対面決済

エンドユーザーがインターネットや電話などを通じて、商品等を購入する決済のことです。

例)ネットスーパー、ダウンロード販売など

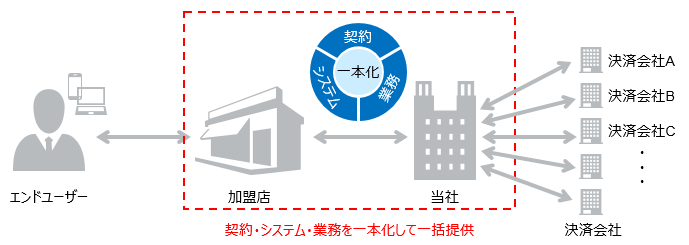

サービス概要

越境パックサービスは、加盟店サイトにオンライン決済機能を導入する際に必要となる、契約・システム・業務を一括して提供するサービスです。詳細は、各サービス概要をご確認ください。

越境パックサービスのイメージ

契約の一本化

当社に申込みするだけで、各種決済手段が利用できます。各決済会社と加盟店との交渉・契約は基本的に不要です。

システムの一本化

当社(ColossalTech株式会社

(以下CT社)のインターフェースで、各種決済手段が利用できます。そのため、決済手段の追加も簡単に実施できます。

業務の一本化

複数の決済手段を利用する場合も売上金の収納は当社より一括で行います。

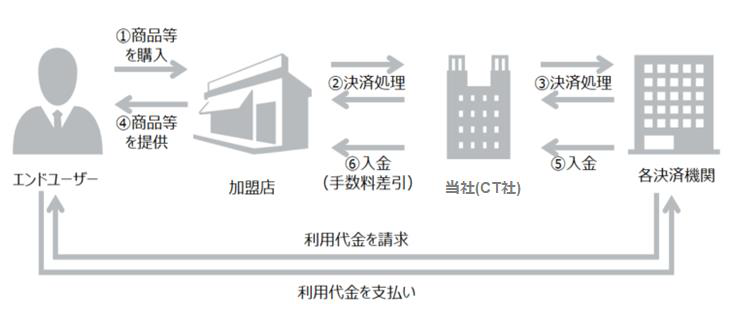

決済の流れ

越境パックを導入する場合、加盟店と決済会社の間に当社が入り、決済や入金に関する処理を代行します。

- エンドユーザーが、加盟店サイトにて商品を購入します。

- 加盟店が、当社に対して決済処理を要求し決済結果の返却を待ちます。

- 当社(CT社)が、決済機関サーバーに対して決済処理を要求し、決済結果を受領後に加盟店へ返却します。

- 加盟店が、エンドユーザーに対して商品を提供します。

- 決済機関が、当社に対して利用代金を入金します。

- 当社が、加盟店に対して利用代金を入金します。

※エンドユーザーと決済会社との請求・支払については、決済機関のエンドユーザー向け規約等に定められたタイミングで実施されます。

利用可能な決済手段

利用可能な決済手段は以下のとおりです。各決済手段の概要については、各決済手段のサービス概要をご参照ください。

| 決済手段カテゴリ | 決済手段 |

|---|---|

| 越境パック | WeChat Pay |

システム接続方式

システムの接続方式は以下のとおりです。

| システム接続方式 | 説明 |

|---|---|

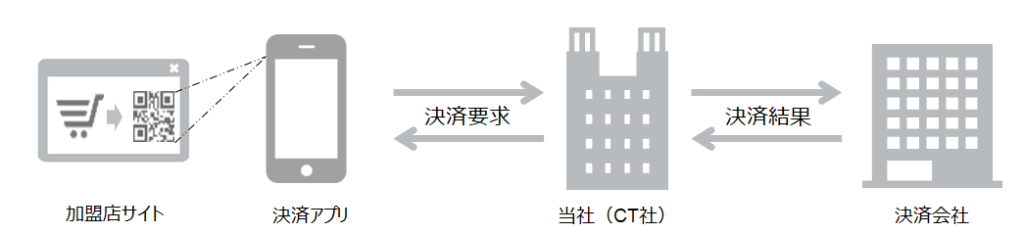

| WEB型 (PC決済) | 加盟店のECサイト上で決済手段ごとのQRコードを表示し、PCに表示されたQRコードをエンドユーザーが決済アプリで読み取っていただき処理を行う方式です。 |

| WEB型 (スマホ決済) | 加盟店のECサイト上でエンドユーザーがスマートフォンにインストールされた決済アプリを使用し処理を行う方式です。 |

| InAPP型 | 加盟店のネイティブアプリから決済情報を取得して、サーバー間連携で処理を行う方式です。 |

| ミニアプリ型 | ユーザーが使用する決済アプリ上に構築した、加盟店のミニアプリから決済情報を取得して処理を行う方式です。 |

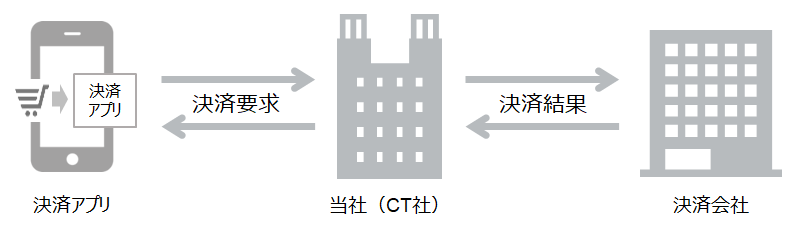

WEB型(PC決済/スマホ決済)

《特長》

- 当社(CT社)が提供するインターフェースを実装いただき、加盟店のサイト上で決済を実施いただきます。

- 加盟店のECサイトから画面遷移しないため、カゴ落ちの防止が期待できます。

《利用イメージ(PC決済)》

《利用イメージ(スマホ決済)》

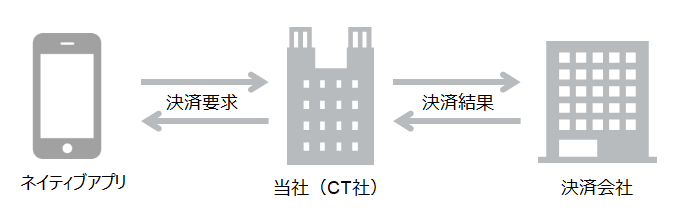

InAPP型

《特長》

- 加盟店のネイティブアプリから決済をいただく形式となるため、加盟店側での遷移などが自由に構築できます。

※WeChat Payについては、ネイティブアプリ側への、「WeChat Pay SDK」の実装が必要となります。

《利用イメージ》

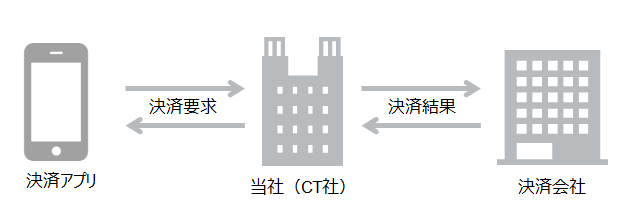

ミニアプリ型

《特長》

- エンドユーザーが使用する決済アプリの中のミニアプリから決済が可能です。

《利用イメージ》

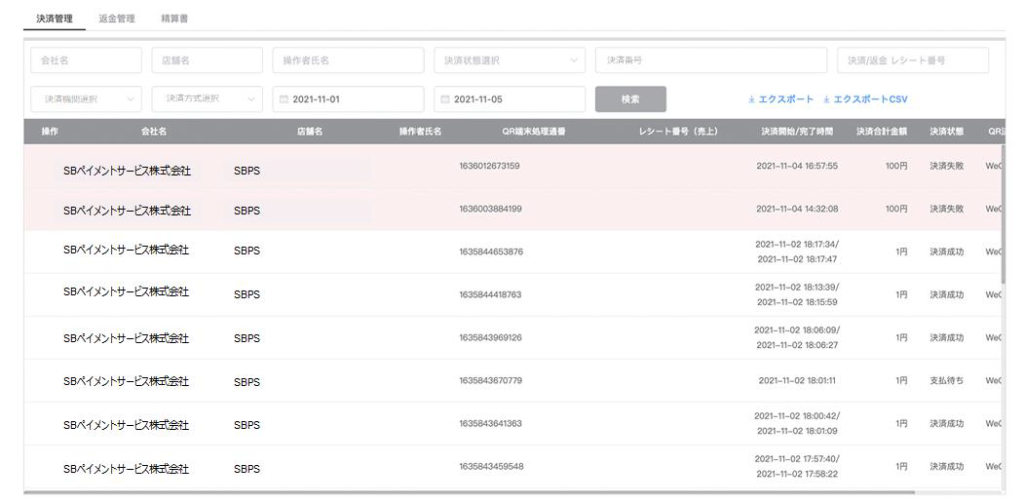

決済管理ツール

越境パックでは、導入後の売上集計や返金処理を簡単に行える管理画面を提供します。管理画面の操作方法は、別途提供いたします、マニュアルをご参照ください。

主な機能

主な機能は以下のとおりです。

- 決済履歴の検索

- 「返金」など決済後の各種処理

画面イメージ

提供機能

越境パックの主な提供機能は以下のとおりです。決済手段ごとに利用可能な機能は異なりますので、各決済手段のサービス概要をご参照ください。

※決済管理ツールの機能は記載していませんので、「SBPS決済管理ツール機能マニュアル」をご参照ください。

| 提供機能名 | 説明 |

|---|---|

| 決済要求 | 購入商品の決済を行う機能です。 |

| 決済履歴検索 | 決済のステータスを確認できる機能です。 |

| 返金要求 | 売上後の取引を全額返金する機能です。 |

| 返金履歴検索 | 返金のステータスを確認できる機能です。 |

| 決済取消 | タイムアウト発生時に実施することで、決済状態の不一致を解消する機能です。 |

| 通関要求 | 通関処理ができる機能です。 |

| 通関履歴検索 | 通関処理のステータスを確認できる機能です。 |

| 通関再要求 | 通関要求を再実施する機能です。 |

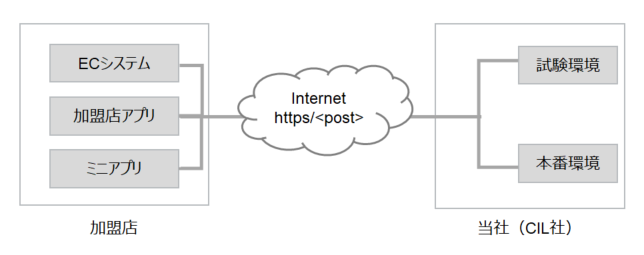

越境パック環境

越境パックでは、専用試験環境と本番環境を提供します。導入時や改修時には、専用試験環境を利用し、リリース時には、本番環境接続先に切り替えて利用ください。ただし、専用試験環境は当社都合により事前連絡なくメンテナンス等によるサービス停止を実施する場合がありますのでご了承ください。

※お申し込みから審査完了後、専用試験環境と、本番環境をご提供致します。

利用イメージ

システム要件(管理画面)

越境パックの管理画面のシステム要件は以下のとおりです。なお、利用実績については全挙動を担保するものではありませんので、必要に応じて加盟店にて確認をお願いします。

| 管理画面対応ブラウザ | JavaScriptとCookieが動作するブラウザ 《利用実績》

|

|---|---|

| 対応OS | 特段制限はございません |

| ネットワーク | インターネット接続環境:必須 |

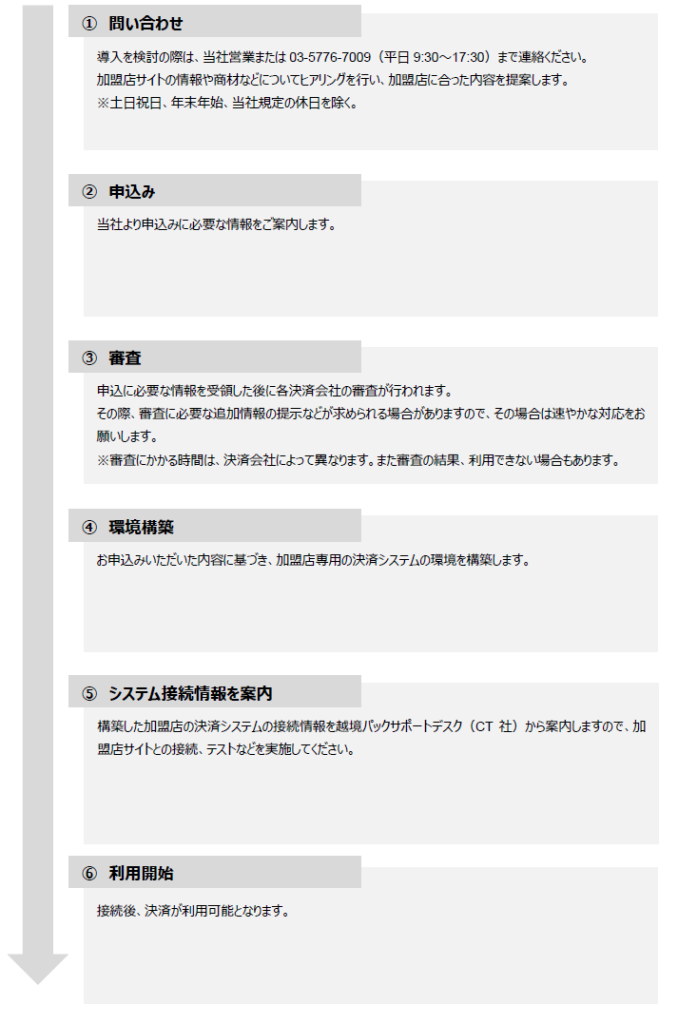

利用開始までの流れ

越境パックの一般的な利用開始までの流れは以下のとおりです。

精算ルール

費用項目について

精算に関わる費用項目は以下のとおりです。

| 項目 | 説明 | 備考 |

|---|---|---|

| 初期費用 | 諸手続き、環境構築等にかかる費用です。サービス開始日の属する月に発生します。 | |

| 月額固定費 | 毎月の運用固定費用です。サービス開始日の属する月から毎月発生します。 | 日割り計算はしません。 |

| 決済手数料 | 商品等、代金の決済処理に関する手数料です。 | |

| 決済サービス利用料 | 越境パック利用に関する手数料です。 | |

| トランザクション費 | システム処理に関する手数料です。 |

※上記以外にも別途費用が発生する場合がありますので、詳しくは申込み時に確認してください。

精算について

売上確定した日を算定基準として、1日から末日までの売上確定処理結果と金額を集計し、売上確定月の翌月10営業日(利用決済手段により翌月21日)までに収納明細書を送付します。売上金は、売上確定月の翌月末(収納明細書を送付した月の月末)に、指定の金融機関口座に支払います。

精算フローの例

留意点

| 項目 | 説明 |

|---|---|

| 精算サイクル |

|

| 請求方法 |

|

| 入金情報の確認 |

|

| 収納明細書 |

|

| その他 |

|

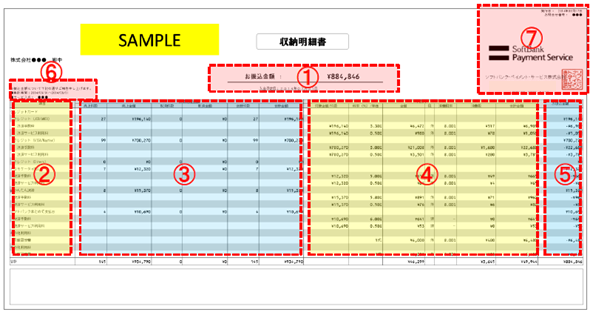

収納明細書イメージ

| 記載項目 | 記載内容 |

|---|---|

| ①合計振込金額・入金日 | 振込指定口座への入金金額および入金日 ※⑤各費用項目の振込金額の合計 |

| ②費用項目 | 導入されている決済手段及びオプション(設定費用含む)についての費用項目 |

| ③決済処理金額 | 各費用項目の売上件数・金額、返金件数・金額、合計件数・金額 |

| ④手数料 | 各費用項目の手数料徴収対象売上および件数、手数料単価、消費税考慮後の手数料合計金額 |

| ⑤振込金額 | 各費用項目の振込金額(マイナス時は請求書発行) ※③決済処理金額の合計金額-④手数料の合計金額 |

| ⑥集計期間・サービス名 | 当該収納明細書の対象決済処理期間およびサービス名 ※サービスID(SID)ごとの記載、収納明細書発行します。 |

| ⑦問合せ番号 | 当社にお問い合わせいただく際の問合せ番号 |

※掲載項目、デザインは変更となる場合がありますので予めご了承ください。

どのページを確認するとよいのか

越境パックを理解していただくために、加盟店担当者の役割に沿った情報を掲載しています。

対象者

運用担当者

加盟店サイトの運営、決済の確認、決済管理ツールへアクセスする方を想定しています。

システム担当者

加盟店サイトの開発、運用、改修、構築などをする方を想定しています。

対象者ごとの説明ページ

| カテゴリ | 対象者 | 概要 | |

|---|---|---|---|

| 運用担当者 | システム担当者 | ||

| はじめにお読みください | ○ | ○ | 越境パックを導入検討する際に、はじめに確認するページです。 |

| サービス概要 | ○ | ○ | 導入する決済手段についてサービス詳細を説明したページです。 |

| API型 越境パックIF仕様 | ― | 〇 | インターフェースに接続するためのシステム仕様です。 |

| 管理ツールマニュアル | 〇 | ― | 決済取引状況を確認できる管理画面ツールの説明ページです。 |

用語の定義

越境パックの各種ドキュメントに使用する用語の定義は、以下のとおりです。

| 用語 | 類義語 | 定義 |

|---|---|---|

| 当社 | SBペイメントサービス株式会社、SBPS | 加盟店と契約する決済代行事業者。 決済手段の契約と収納を行います。 |

| CT社 | ColossalTech株式会社 CT | 加盟店と接続するゲートウェイ事業者。 決済に関わるお問い合わせ先サポートデスク。 |

| 加盟店 | 貴社、事業者 | 当社の越境パックを契約した会社 |

| エンドユーザー | エンドユーザー、ユーザー、ユーザ、利用者、お客さま | 加盟店サービスの利用者 |

| 決済会社 | 決済機関 | 当社の越境パックを介して決済サービスを提供する会社 |

| デバイス | 端末 | Webサイトへアクセスする機器 |

| 決済 | 精算、支払い | 加盟店とエンドユーザー間の売買取引における金銭のやりとり |

| 決済手段 | 決済方法 | 商品等の代金を支払う手段 |

| 決済ステータス | – | 決済の取引状況 |

| 決済処理 | – | システムによる決済情報の送受信 |

| 課金処理 | – | 商品等の代金を課すること |

| チャージバック | – | 不正利用等の理由により利用代金の決済に同意しない場合、決済機関がその利用代金の売上を取り消すこと |

| レギュレーション | – | 決済会社が指定する加盟店向け利用規定 |

| アクセプタンスマーク | – | 決済手段が利用可能なことを示すマーク |

| API | – | Application Programming Interfaceの略 プログラミングの際に使用できる命令や規約、関数等の集合のこと |

| I/F | IF、インターフェース | Interfaceの略 異なるシステムを接続する装置やソフトウェアのこと |

| SSL通信 | – | Secure Sockets Layerの略 インターネット上で情報を暗号化して送受信できる技術のこと |

| ネイティブアプリ | 加盟店アプリ | サービス提供事業者で用意をするアプリ |

| InAPP | – | 越境パックの接続方式の1つ。 加盟店のネイティブアプリから決済情報を取得して、サーバー間連携で処理を行う方式。 |

| SDK | ソフトウェア開発キット | ネイティブアプリから決済の通信を行うための、インターフェイスを提供。 |

| ミニアプリ | ミニプログラム | 決済アプリの中に含まれている、様々なサービスアプリ。決済アプリ上で、シームレスに使用できる機能。 |

| WEB型(PC決済) | MPM | 加盟店のECサイト上で決済手段ごとのQRコードを表示し、PCに表示されたQRコードをエンドユーザーが決済アプリで読み取っていただき処理を行う方式です。 |

| WEB型(スマホ決済) | H5決済 | 加盟店のECサイト上でエンドユーザーがスマートフォンにインストールされた決済アプリを使用し処理を行う方式。 |