PayPay(オンライン決済)とは

PayPay(オンライン決済)とは、PayPay社が提供する決済手段です。PayPayアカウントに登録した支払情報を利用して、商品等の代金支払いを行うことができます。

エンドユーザーは、PayPay(残高)、PayPay(クレジット)※旧あと払いを利用して支払いできます。

PayPayについては、以下サイトも参照ください。URLは変更となる場合があります。

〈PayPay〉

https://paypay.ne.jp/

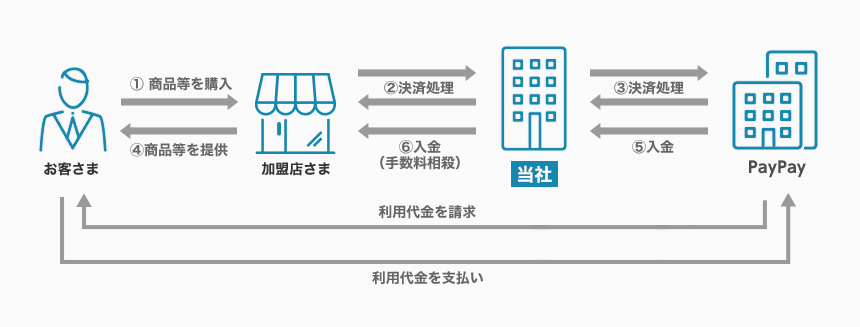

サービス概念図

主な特徴

- エンドユーザーはお持ちのPayPayアカウントで簡単に買い物ができます。

- PayPay残高を利用して支払いができます。

- 個人情報を加盟店が取得する必要がないため、安心・安全に利用できます。

エンドユーザー向け利用情報

購入手順については、サービスサイトに概要を掲載しておりますのでご確認ください。

エンドユーザー向けの利用情報についてはFAQ(決済・システム仕様>PayPay(オンライン決済))もしくは各決済機関のページをご確認ください。

サービス仕様

基本仕様

利用可能な課金方式と課金方式別の基本仕様は以下のとおりです。決済管理ツールで行う売上確定や取消などの各種処理期間は、決済管理ツールに従います。

課金方式

| 都度課金 | ○ |

|---|---|

| 継続課金(簡易) | × |

| 継続課金(定期・従量) | ○ |

基本仕様

| 課金方式 | 項目 | 仕様 | |

|---|---|---|---|

| 都度課金 | 売上方式 | 自動売上 | ○ |

| 指定売上 | ○ | ||

| 売上確定期限 | 自動売上の場合:売上確定不要 指定売上の場合:購入完了時点から30日後の同時刻まで ※1※2 | ||

| 取消可能期間 | 自動売上の場合:取消機能無し 指定売上の場合:購入完了時点から30日後の同時刻まで | ||

| 返金可能期間 | 決済日翌日を一日目として、365日 | ||

| 返金可能回数 | 50回/トランザクション | ||

| 継続課金(定期・従量) | 売上方式 | 自動売上 | ○ |

| 指定売上 | × | ||

| 継続課金処理 | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 自動売上のため売上確定不要 | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 自動売上のため無し ※3 | ||

| 返金可能期間 | 決済日翌日を一日目として、365日 | ||

| 返金可能回数 | 50回/トランザクション | ||

| 最終決済処理日からの継続課金の有効期限 | 365日 | ||

※2:増額売上の場合は、売上確定期限の6時間前までしか処理できません。

※3:プッシュ課金取消において、支払期限内、且つエンドユーザーまだ同意されない場合いつでも取消できます。

対応デバイス

利用可能なデバイスは以下のとおりです。

| デバイス | 利用可否 | 備考 |

|---|---|---|

| PC | ○ | – |

| スマートフォン | ○ | – |

| 携帯 | × | – |

提供機能一覧

以下の機能を提供しています。決済管理ツールの機能は、主な機能のみを記載しています。詳しくは決済管理ツールマニュアルにて確認ください。

| 課金方式/売上方式 | 提供機能 | リンク型 | API型 | 決済管理ツール |

|---|---|---|---|---|

| 都度課金/自動売上 | 購入 | ○ | – | – |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○ | ○ | |

| 複数回返金 | – | ○ | ○ | |

| 決済結果参照 | – | ○ | – | |

| 都度課金/指定売上 | 購入 | ○ | – | – |

| 売上 | – | ○ | ○ | |

| 部分売上 ※1 | – | ○ | ○ | |

| 増額売上 | – | ○ | ○ | |

| 増額売上確定通知 | – | ○ | – | |

| 増額売上期限切れ通知 | – | ○ | – | |

| 取消 | – | ○ | ○ | |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○ | ○ | |

| 複数回返金 | – | ○ | ○ | |

| 決済結果参照 | – | ○ | – | |

| 継続課金(定期・従量) | 継続課金(定期・従量)申込 | ○ | – | – |

| 継続課金(定期・従量)購入 | – | ○ | ○ | |

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | |

| ユーザー解約通知 ※2 | – | ○ | – | |

| プッシュ課金購入 | – | ○ | ○ | |

| プッシュ課金確定通知 | – | ○ | – | |

| プッシュ課金取消 | – | ○ | – | |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○ | ○ | |

| 複数回返金 | – | ○ | ○ | |

| 継続課金(定期・従量)申込状態参照 ※3 | – | ○ | – | |

| 決済結果参照 | – | ○ | – |

※2:エンドユーザーがPayPayアプリ側から継続課金(定期・従量)の解約ができます。解約後、本機能で加盟店にその解約を通知します。

※3:本機能で継続課金(定期・従量)の申込状態(申込中or解約済み)を参照できます。

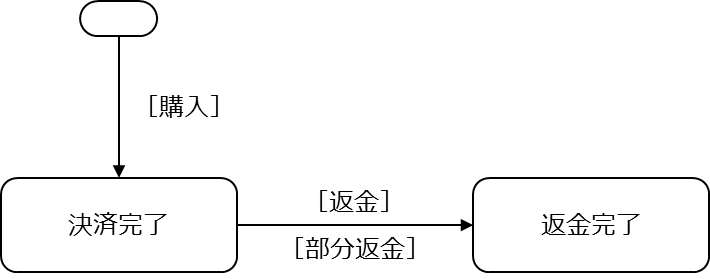

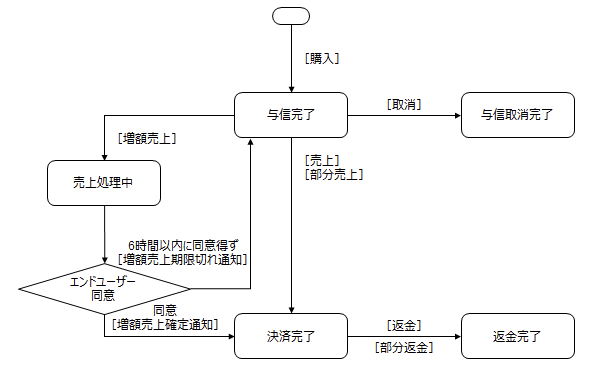

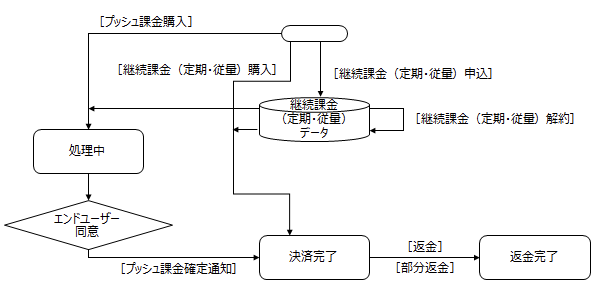

決済ステータス遷移

提供している各機能を実施することで、下記のように決済のステータスが遷移します。各機能の実施方法については、リンク型 IF仕様、API型 IF仕様、および「SBPS決済管理ツール機能マニュアル」をご参照ください。

《都度課金/自動売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 返金 | – | 取消返金要求 ST02-00306-311 | 請求情報画面 「返金」 |

| 部分返金 | – | 取消返金要求 ST02-00306-311 | 請求情報画面 「複数回部分返金」※1 |

| 複数回返金 | – | 複数回部分返金要求 ST02-00308-311 | 請求情報画面 「複数回部分返金」※1 |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-311 決済結果参照要求_決済番号返却 MG01-00102-311 | – |

《都度課金/指定売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 売上 | – | 売上要求 ST02-00201-311 | 請求情報画面 「売上」 |

| 部分売上 | – | 売上要求 ST02-00201-311 | 請求情報画面 「売上」※1 |

| 増額売上 | – | 売上要求 ST02-00201-311 | 請求情報画面 「売上」※1 |

| 増額売上確定通知 | – | 増額売上確定通知 NT01-00110-311 | – |

| 増額売上期限切れ通知 | – | 増額売上期限切れ通知 NT01-00112-311 | – |

| 取消 | – | 取消返金要求 ST02-00303-311 | 請求情報画面 「取消」 |

| 返金 | – | 取消返金要求 ST02-00303-311 ※2 | 請求情報画面 「返金」 |

| 部分返金 | – | 取消返金要求 ST02-00303-311 ※2 | 請求情報画面 「複数回部分返金」※3 |

| 複数回返金 | – | 複数回部分返金要求 ST02-00308-311 | 請求情報画面 「複数回部分返金」 ※3 |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-311 決済結果参照要求_決済番号返却 MG01-00102-311 | – |

※2:自動売上の返金要求(ST02-00306-311)/複数回部分返金要求(ST02-00308-311)も利用できます。

※3:「複数回部分返金」ボタンを押してから、金額と枝番を入力したうえに実行してください。

《継続課金(定期・従量)の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 継続課金(定期・従量) 申込 | 継続課金(定期・従量) 申込要求 D01-1 | – | – |

| 継続課金(定期・従量) 購入 | – | 継続課金(定期・従量) 購入要求 ST01-00104-311 継続課金(定期・従量) 購入要求_決済番号返却 ST01-00107-311 | 継続課金(定期・従量) ユーザー情報画面 「購入」 |

| 継続課金(定期・従量) 解約 | 継続課金(定期・従量) 申込要求 D01-1 | 継続課金(定期・従量) 解約要求 ST02-00309-311 | 継続課金(定期・従量) ユーザー情報画面 「解除」 |

| ユーザー解約通知 | – | ユーザー解約通知 NT01-00111-311 ※5 | – |

| プッシュ課金購入 | – | プッシュ課金購入要求(支払リクエスト) ST01-00106-311 | 継続課金(定期・従量) ユーザー情報画面 ※3 「プッシュ課金購入」 |

| プッシュ課金確定通知 | – | プッシュ課金確定通知(支払リクエスト) NT01-00113-311 プッシュ課金確定通知(支払リクエスト)_決済番号返却 NT01-00114-311 ※4 | – |

| プッシュ課金取消 | – | 取消返金要求 ST02-00303-311 | – |

| 返金 | – | 取消返金要求 ST02-00303-311 ※2 | 請求情報画面 「返金」 |

| 部分返金 | – | 取消返金要求 ST02-00303-311 ※2 | 請求情報画面 「複数回部分返金」 ※1 |

| 複数回返金 | – | 複数回部分返金要求 ST02-00308-311 | 請求情報画面 「複数回部分返金」 ※1 |

| 継続課金(定期・従量)申込状態参照 | – | 継続課金(定期・従量) 申込状態参照 MG01-00103-311 | – |

| 決済結果参照 | – | 決済結果参照要求 MG01-00101-311 決済結果参照要求_決済番号返却 MG01-00102-311 | – |

※2:自動売上の返金要求(ST02-00306-311)/複数回部分返金要求(ST02-00308-311)も利用できます。

※3:決済管理ツールより、継続課金(定期・従量)購入を実施し、ユーザー残高不足時のみ本機能利用できます。

※4:プッシュ課金購入要求(支払リクエスト)に「決済番号返却フラグ」を「返却あり」と設定される際に、本機能でブッシュ課金確定通知されます。

※5:ユーザがPayPayアプリから申込を解除する際、あるいはユーザがPayPayアカウントを解約する際に、本機能で通知されます。

注意事項

エンドユーザーにおける支払い/申込の時間制限

都度課金の場合、PayPayの画面に遷移してから購入完了するまで、5分間の時間制限がありますのでご注意ください。5分を超えた場合エンドユーザーによる決済が失敗となります。

継続課金(定期・従量)の場合、PayPayの申込画面に遷移してから申込完了するまで、15分間の時間制限がありますので、ご注意ください。15分を超えた場合エンドユーザーによる申込が失敗となります。

加盟店決済上限金額について

PayPay社審査結果により、月間決済上限金額を設けられる場合がございます。

増額売上について

PayPay(オンライン決済)は与信金額以上金額の売上(増額売上)処理はできます。増額売上時、エンドユーザーのPayPayアプリにプッシュ通知が送信され、エンドユーザーは同意した際に、売上処理が正常完了となり、増額売上確定通知機能で加盟店へ通知します。一方、プッシュ通知から6時間以内、エンドユーザーの同意をもらえない場合、売上処理ができず、増額売上期限切れ通知機能で加盟店に通知します。

なお、与信有効期間内、ユーザーの同意をもらえない場合、再度増額売上を実施することも可能です。

また、増額売上の場合は、売上確定期限の6時間前までしか処理できません。

PayPayアプリ連動

PayPayアプリがインストールされたスマートフォンから購入、申込する際に、PayPayアプリ自動的に立ち上がり、アプリでの支払い、利用同意となります。但し、スマートフォンのブラウザがSafari、Chrome、UC、firefox以外の場合、連動されないこともありますので、ご了承ください。※継続課金(定期・従量)申込の場合、申込要求(D01-1)での設定が必要となりますので、ご注意ください。設定詳細は「リンク型 継続課金(定期・従量)申込要求」をご参照ください。

PayPayアカウントでログインする際の対応ブラウザ

PCから支払う場合とPayPayアプリがインストールされてないスマートフォンから支払う場合において、エンドユーザーはブラウザにPayPayアカウントでログインし、支払われます。サポート対象ブラウザはChrome、Safari、firefox、Edgeの最新版となります。なお、シークレットブラウザ、プライベートモードでのご利用はできませんので、ご注意ください。

継続課金(定期・従量)の用途

継続課金(定期・従量)は都度課金に利用できませんので、ご注意ください。

継続課金(定期・従量)解約の単位

同一PayPayアカウント前提で、継続課金(定期・従量)解約は弊社への申込単位(MSID単位)となります。他の決済手段と異なりますので、ご注意ください。

例:加盟店のABCDオンラインショップがPayPay(オンライン決済)継続課金(定期・従量)を導入される場合、甲、乙、丙の商材があります。同一PayPayアカウントより、甲、乙、丙それぞれで申込、課金されることができますが、甲、乙、丙いずれを解約する場合、ABCDオンラインショップ配下、同一PayPayアカウントより申し込んだ全商材(甲、乙、丙)も解約されます。

継続課金(定期・従量)のプッシュ課金購入機能について

継続課金(定期・従量)購入要求を実施したところ、エンドユーザー残高不足で課金できない場合、本機能のご利用により、エンドユーザーのPayPayアプリにプッシュ通知を送信され、支払いを求めることができます。エンドユーザーは同意した際に、プッシュ課金確定通知機能で加盟店へ通知します。またプッシュ課金取消機能でプッシュ課金購入をキャンセルすることができます。

加盟店はプッシュ課金購入の支払期限を設定できます。設定方法は「API型 PayPay(オンライン決済)IF仕様」をご参照ください。

プッシュ課金確定通知機能において、加盟店側レスポンスがNGで返却される際に、自動返金処理されませんので、必ず返金して頂くようお願いします。

継続課金(定期・従量)の試験環境の屋号表示について

SBPSの包括代理の加盟店において、SBPSご提供のテストアカウントを使って、PayPayアプリ開発者モードから継続課金(定期・従量)解約のテストをされる際に、お申込みのマーチャントIDとサービスID組合せではじまる数列で表示されている屋号表示のデータを対象にしてください。テストアカウントは全加盟店共通のため、他の加盟店の申込データも見られますが、誤って解約しないようご注意ください。

継続課金(定期・従量)の導入基準について

PayPay社のレギュレーションにより、継続課金(定期・従量)の利用対象は、定期購入商品のみとなります。都度購入商品は定期購入商品と同時に継続課金(定期・従量)をご利用される場合、加盟店に二要素認証を含むセキュリティ基準を満たす必要があります。

| 継続課金(定期・従量)のご利用対象 | 商品属性 | 区分 | セキュリティ基準 |

|---|---|---|---|

| 定期購入商品のみ | ― | ― | セキュリティ基準なし |

| 定期購入商品と都度購入商品 | デジタルコンテンツ | 非前払い式商材 | |

| 前払い式商材 | セキュリティ基準を満たす必要 | ||

| 物販・役務 | ― |

※二要素認証:「ユーザーだけが知っている何か」「ユーザーだけが所有している何か」「ユーザー自身の特性(指紋など)」のうち、2つの要素を組み合わせてユーザーの身元を確認

PayPay(クレジット)※旧あと払いについて

ユーザのPayPayアカウントにPayPay(クレジット)※旧あと払いを設定済みの場合、PayPay(残高)以外、PayPay(クレジット)※旧あと払いでの支払いもできます。

なお、以下業種はあと払い不可業種とされているため、ご了承、ご理解ください。

・特定継続的役務(エステ/美容医療/学習塾/英会話教室/結婚相談所等)

・タバコ及びその関連商品

・薬局、ドラッグストア

・公営ギャンブル

・不動産賃貸

・保険(貯蓄型保険)

・興行チケット(再販事業者の場合のみ)

・商品券、プリペイドカード(地域限定のものを除く)

指定売上個別仕様におけるPayPay(クレジット)※旧あと払いについて

PayPay社は一部加盟店に指定売上確定期限の個別仕様を提供しています。この場合、ユーザがあと払いを選択している決済において、ユーザの与信状況により、売上確定期限内(※)の売上要求でも与信期限超過のエラーが発生することがあります。

PayPay社から指定売上確定期限の個別仕様の提供を受ける場合は、予めご了承ください。

※購入要求完了から30日後の同時刻までの売上要求は、エラーになりません。

不正利用調査およびチャージバック

エンドユーザーから商品不備や利用覚え無しなどの申し出や、第三者による不正利用の疑いなどにより、PayPay社から不正利用調査およびチャージバック(債権買取拒否)が発生する場合があります。当社がPayPay社から連絡を受けた場合、速やかに加盟店に状況を連絡しますので、連絡内容に沿って対応ください。なお、チャージバックが確定した場合、当該売上金額は精算対象外となり、加盟店負担となります。詳しくは、申込時に提供する重要事項説明書を参照ください。

仕様について

PayPay(オンライン決済)は、PayPay社が提供するサービスをオンライン決済ASPに組み込み提供しています。PayPay社にて仕様変更や経済条件の変更等を行った場合は、それに伴い当社が提供するPayPay(オンライン決済)の仕様も変更となる場合がありますのでご了承ください。

メンテナンス等によるサービス停止

オンライン決済ASPは、不定期にメンテナンスを行います。メンテナンスによるサービス停止がある場合はあらかじめ通知のうえ、サービス停止します。1週間前までに通知することを基本としています。ただし、緊急メンテナンスによる場合はその限りではありません。

また、当社のシステム以外で、PayPay社やPayPay社提携先等のシステムメンテナンスや不具合によるサービス停止が発生した場合、状況がわかり次第、速やかに加盟店に通知のうえ、原因究明をします。原因判明でき次第、加盟店に通知するようにしますが、当社に起因しない場合、原因判明に時間がかかる場合があることを予めご了承ください。

返金

返金処理が売上金の締め日にかかる場合、締め処理開始の前後によって、ユーザーに返金されるタイミングが異なります。

・締め処理開始前の返金 :即時返金

・締め処理開始後の返金(返金額を上回る売上金がある場合):即時返金

・締め処理開始後の返金(売上金が返金額を下回る場合) :返金が保留され、売上金が返金額を上回った時点で返金

継続課金(定期・従量)のクレジット限定機能について

継続課金のお支払方法をPayPayクレジットに限定する機能となります。

本機能をご利用いただいた場合、購入対象はPayPayクレジットをお持ちのユーザーのみとなります。

継続課金(クレジット限定利用あり)から継続課金(クレジット限定利用なし)、またはその逆の切り替えは不可です。

切替をご希望される場合は別途お申込みが必要となります。

なお、お取扱い可能な業種は以下となります。

| スーパーマーケット(生鮮食品含む) | 食品・飲料販売 | 酒類販売 | 化粧品販売 |

| コンタクトレンズ販売 | 健康食品販売 | 銃器・刀剣販売 | 墓地・墓石販売 |

| その他物販 | カラオケボックス | 有料道路・高速道路 | 通信事業者(電話・プロバイダ) |

| 新聞・雑誌定期購読 | CATV | 寄付・募金 | エステティックサロン ※ |

| 冠婚葬祭業 | 永代供養 | 互助会 | 不動産(賃貸) |

| 駐車場(月極) | 不動産(敷金) | 社会福祉・介護(保育所、介護保険施設等) | 社会福祉・介護(有料老人ホーム、高齢者向け住宅等) |

| 学習塾・進学塾・予備校 ※ | 家庭教師 ※ | レンタルショップ(映像・音楽・書籍) | デジタルコンテンツ(書籍) |

| デジタルコンテンツ(音楽) | デジタルコンテンツ(ゲーム) | デジタルコンテンツ(動画) | スポーツクラブ |

| 外国語会話教室・カルチャースクール ※ | 占い | オンライン占い・電話占い | カジノ |

| RMT(リアルマネートレード) | 損害保険 | 生命保険 | 送金サービス |

| 銀行・信用金庫・労働金庫・ファイナンス | 電子マネー・プリペイドカードチャージ | 仮想通貨交換所 | 国際送金・外貨・トラベラーズチェック・小包 |

| ハウスカード | オークション | クラウドファンディング | その他のCtoCサービス |

| 投げ銭 | 出会い系サイト・マッチングサイト・結婚相談所 ※ | タトゥー・彫師 | 探偵 |

| 宗教団体 | 政党・政治資金団体 | 性風俗関係 | クーポンサイト・ギャザリング |

| その他サービス | その他権利販売 | 情報商材販売 | 個人輸入代行 |

| ポイントサイト・モニターサイト |

※特定継続的役務に該当する場合はお取扱いいただけません。

補足情報

PayPayアプリ開発者モード

2020/9/25より、PayPayアプリの開発者モードでログインすれば、SBPSご提供のステージング環境でもご利用できます。

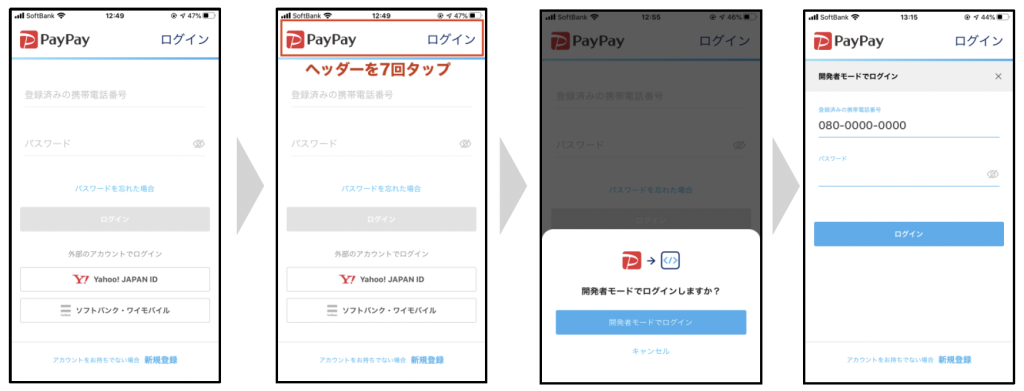

利用手順:

- PayPayアプリを立ち上げ、ログイン画面を開きます。

※実アカウントでログインされている場合、いったんログインアウトが必要です。 - ログイン画面のヘッダー部を7回タップし、「開発者モードでログイン」を選択します。

- SBPSご提供のテストアカウントでログインします。

※実アカウントでのログインはできません。

※SBPSご提供のテストアカウントは決済環境構築完了時の接続情報シートに掲載しています。

※ログアウトすると、開発者モードも終了されます。

PayPayデータ、SBPSデータの突合

PayPayと直契約の場合、精算等の運用で、PayPayデータとSBPSデータを突合する必要な場合、以下をご参照ください。

| PayPayデータ (取引データFTP/SFTP連携) | SBPSデータ | |

|---|---|---|

| 接続I/F情報 | 決済管理ツール CSVダウンロード | |

| 決済番号(order_id) | ・購入結果CGI:「res_payinfo_key」 ・決済結果参照要求_決済番号返却レスポンス/継続課金(定期・従量)購入要求_決済番号返却レスポンス/プッシュ課金確定通知(支払リクエスト)_決済番号返却レスポンス:「payment_id」 | 決済番号 |

| 加盟店ID(merchantId) | – | – |

| 屋号(brandName) | – | – |

| 店舗ID(storeId) | – | – |

| 店舗名(storeName) | – | |

| 端末番号(terminalId) | – | – |

| 取引ステータス(transactionStatus) | – | – |

| 取引日時(acceptedAt) | – | – |

| 取引金額(amount) | 各購入要求、売上確定要求、取消返金要求:「amount」 | 請求金額 |

| レシート番号(orderReceiptNumber) | – | – |

| 支払方法(methodOfPayment) | – | – |

| マーチャント決済ID(merchantPaymentId) | 上記の取引ステータス(transactionStatus)の値により変動 ※以下《別表》参照 | – |

《別表》

| マーチャント決済ID(merchantPaymentId) | 取引ステータス(transactionStatus) | SBPS 接続I/F情報 |

|---|---|---|

| AUTHORIZED | 購入結果CGIの「res_tracking_id」 | |

| FAILED | – | |

| CANCELED | 取消返金要求のレスポンスの「res_sps_transaction_id」 | |

| COMPLETED | ・自動売りの場合:購入結果CGIの「res_tracking_id」 ・指定売りの場合:売上要求のレスポンスの「res_sps_transaction_id」 | |

| EXPIRED | 購入結果CGIの「res_tracking_id」 | |

| REFUNDED | 取消返金要求のレスポンスの「res_sps_transaction_id」 |