au PAY(auかんたん決済)とは

au PAY(auかんたん決済)とは、KDDIが提供する決済手段です。AuまたはUqmobileに登録した通話料の支払情報を利用して、商品等の代金支払いを行うことができます。

エンドユーザーは、以下の支払方法を利用できます。

《au電話料金合算払い、Uqmobile電話料金合算払い》

月々の携帯電話料金と合わせて支払う方法

《au PAY 残高払い》

事前にチャージされているau PAY残高で支払う方法

《au PAY カード払い》

事前に登録しているau PAY カードで支払う方法

※クレジットカード払いを支払方法に追加したい場合、別途申込みが必要です。

なお、au PAY(auかんたん決済)は、PC、スマートフォンサイト向け決済手段となります。

au PAY(auかんたん決済)については、以下サイトも参照ください。URLは変更となる場合があります。

〈au PAY(auかんたん決済)〉

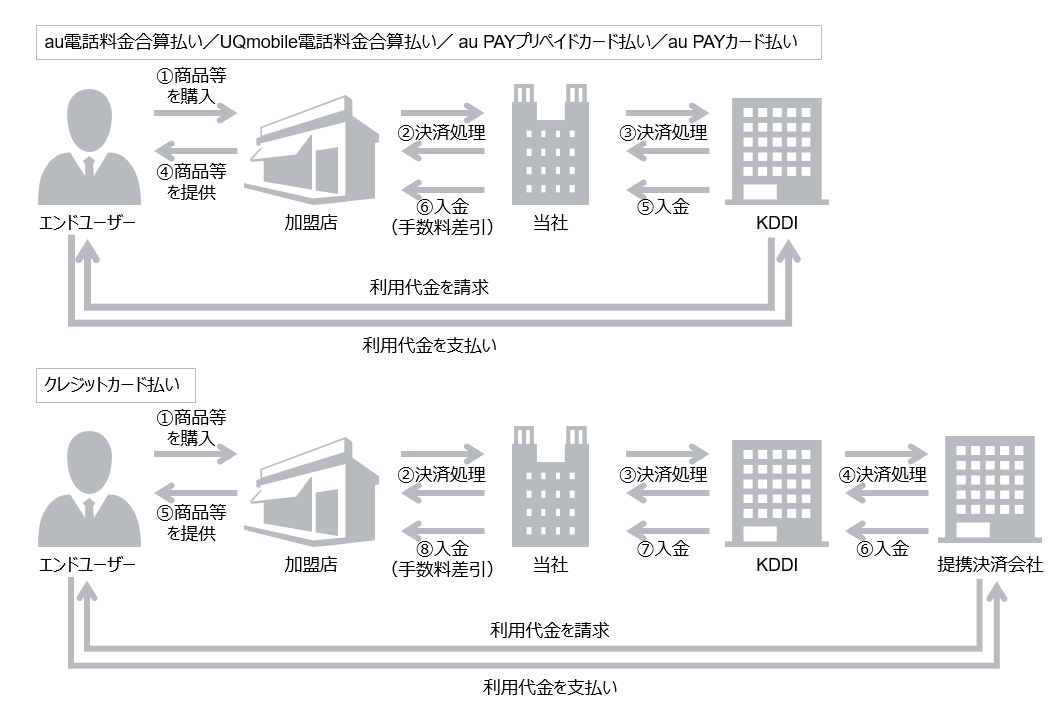

サービス概念図

主な特徴

- au、UqmobileのID、パスワードだけで簡単にお買物ができます。

- 利用代金は月々の携帯電話料金とまとめて請求となるため、支払いがとても便利です。

- クレジットカード番号等の個人情報を加盟店が取得する必要がないため、安心・安全に利用できます。

エンドユーザー向け利用情報

購入手順については、サービスサイトに概要を掲載しておりますのでご確認ください。

エンドユーザー向けの利用情報についてはFAQ(決済・システム仕様>au PAY(auかんたん決済))もしくは各決済機関のページをご確認ください。

サービス仕様

基本仕様

利用可能な課金方式と課金方式別の基本仕様は以下のとおりです。決済管理ツールで行う売上確定や取消などの各種処理期間は、決済管理ツールに従います。

課金方式

| 課金方式 | 利用可否 | 備考 |

|---|---|---|

| 都度課金 | ○ | – |

| 継続課金(簡易) | ○ | au PAY プリペイドカード払いは、利用できません。 クレジットカード払いを併用される場合、デビットカード・プリペイドカードは利用できません。 |

| 継続課金(定期・従量) | ○ | au電話料金合算払いのみ利用できます。 クレジットカード払いを併用される場合は、その他支払方法も含めてご利用できません。 |

基本仕様

| 課金方式 | 項目 | 仕様 | |

|---|---|---|---|

| 都度課金 | 売上方式 | 自動売上 | ○ |

| 指定売上 | ○ | ||

| 売上確定期限 | 自動売上の場合:売上確定不要 指定売上の場合:購入要求処理日を含む90日後まで | ||

| 取消可能期間 | 自動売上の場合:取消機能無し 指定売上の場合:購入要求処理日を含む90日後まで | ||

| 返金可能期間 | 売上確定処理日を含む翌々月末まで | ||

| 継続課金(簡易) | 売上方式 | 自動売上 | ○ |

| 指定売上 | × | ||

| 継続課金処理(与信) | 初月:加盟店にて課金処理を実施 2ヵ月目以降:不要 | ||

| 売上処理日 | 毎月1日に当社にて自動課金 | ||

| 課金処理不可通知日 | 毎月1日から順次返却 | ||

| 返金可能期間 | 購入要求処理日を含む翌々月末まで ※初月課金分は、購入要求処理日の翌月1日以降より返金できます。 | ||

| 選択機能 | 初月有料/無料、初月解約時課金する/しないのオプションが選択可 | ||

| 継続課金(定期・従量) | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 購入要求処理日、または継続課金(定期従量)購入要求処理日を含む90日後まで | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 購入要求処理日、または継続課金(定期従量)購入要求処理日を含む90日後まで | ||

| 返金可能期間 | 売上確定処理日を含む翌々月末まで | ||

| 最終決済処理日からの継続課金の有効期限 | 365日 | ||

対応デバイス

利用可能なデバイスは以下のとおりです。

| デバイス | 利用可否 | 備考 |

|---|---|---|

| PC | ○ | – |

| スマートフォン | ○ | – |

| 携帯 | × | – |

提供機能一覧

以下の機能を提供しています。決済管理ツールの機能は、主な機能のみを記載しています。詳しくは決済管理ツールマニュアルにて確認ください。

| 課金方式/ 売上方式 | 提供機能 | リンク型 | API型 | 決済管理ツール |

|---|---|---|---|---|

| 都度課金/ 自動売上 | 購入 | ○ | – | – |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○※1 | ○※1 | |

| 都度課金/ 指定売上 | 購入 | ○ | – | |

| 売上 | – | ○ | ○ | |

| 部分売上 | – | ○※2 | ○※2 | |

| 取消 | – | ○ | ○ | |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○※1 | ○※1 | |

| 継続課金 (簡易) | 購入 | ○ | – | – |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | – | ○※1 | |

| 継続課金(簡易)解約 | ○ | ○ | ○ | |

| 継続課金(簡易)解約通知 | ○ | – | – | |

| 継続課金 (定期・従量) | 購入 | ○ | – | – |

| 売上 | – | ○ | ○ | |

| 部分売上 | – | ○ | ○ | |

| 取消 | – | ○ | ○ | |

| 返金 | – | ○ | ○ | |

| 部分返金 | – | ○※1 | ○※1 | |

| 継続課金(定期・従量)申込 | ○ | – | – | |

| 継続課金(定期・従量)再申込 | ○ | – | – | |

| 継続課金(定期・従量)購入 | – | ○ | ○ | |

| 継続課金(定期・従量)解約 | ○ | ○ | ○ |

※2:支払方法がクレジットカード払いの場合は、部分売上できません(エラーとなります)。その他の支払方法ではご利用できます。

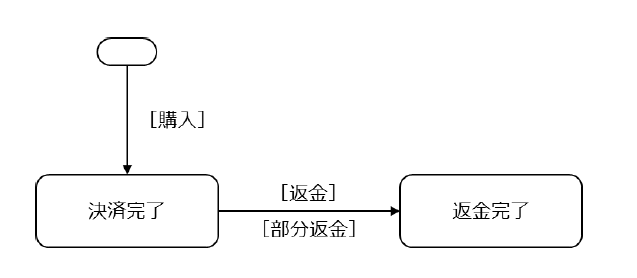

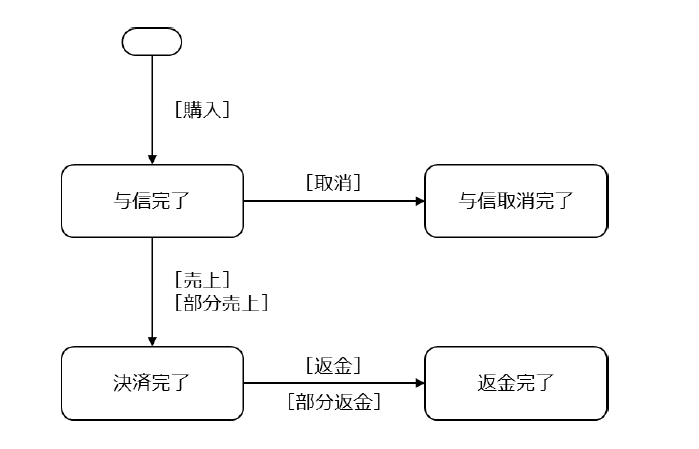

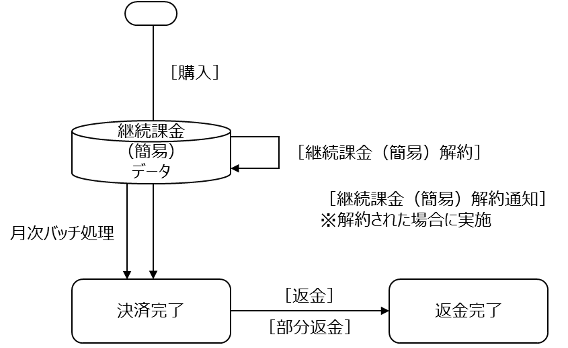

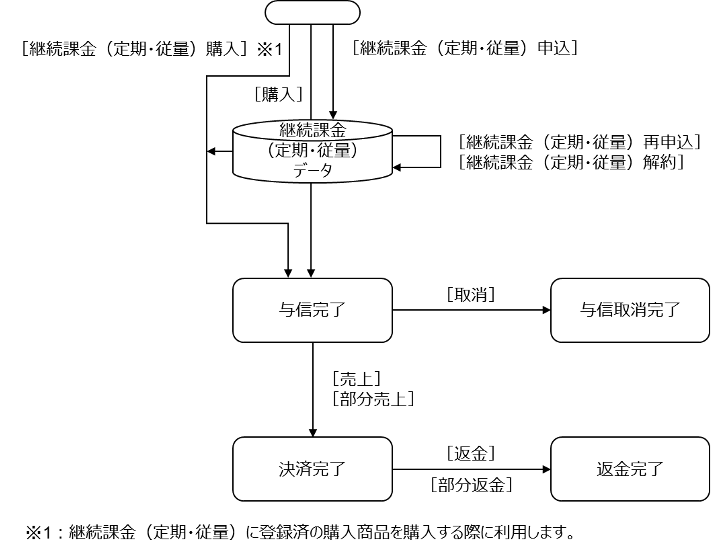

決済ステータス遷移

提供している各機能を実施することで、以下のように決済のステータスが遷移します。各機能の実施方法については、リンク型 IF仕様、API型 IF仕様、および「SBPS決済管理ツール機能マニュアル」を参照ください。

《都度課金/自動売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au返金」 |

| 部分返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au部分返金」 |

《都度課金/指定売上の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 売上 | – | 売上要求 ST02-00201-402 | 請求情報画面 「au売上」 |

| 部分売上 | – | 売上要求 ST02-00201-402 | 請求情報画面 「au部分売上」 |

| 取消 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au取消」 |

| 返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au返金」 |

| 部分返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au部分返金」 |

《継続課金(簡易)の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au返金」 |

| 部分返金 | – | – | 請求情報画面 「au部分返金」 |

| 継続課金(簡易) 解約 | 購入要求 A01-1 | 継続課金(簡易) 解約要求 ST02-00302-402 | 継続課金(簡易) ユーザー情報画面 「解約する」 |

| 継続課金(簡易) 解約通知 | 購入結果CGI A02-1 | – | – |

《継続課金(定期・従量)の場合》

| 提供機能 | リンク型 処理名・機能ID | API型 処理名・機能ID | 決済管理ツール 画面名・ボタン名 |

|---|---|---|---|

| 購入 | 購入要求 A01-1 | – | – |

| 売上 | – | 売上要求 ST02-00201-402 | 請求情報画面 「au売上」 |

| 部分売上 | – | 売上要求 ST02-00201-402 | 請求情報画面 「au部分売上」 |

| 取消 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au取消」 |

| 返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au返金」 |

| 部分返金 | – | 取消返金要求 ST02-00303-402 | 請求情報画面 「au部分返金」 |

| 継続課金(定期・従量)申込 | 継続課金(定期・従量) 申込要求 D01-1 | – | – |

| 継続課金(定期・従量)再申込 | 継続課金(定期・従量) 申込要求 D01-1 | – | – |

| 継続課金(定期・従量)購入 | – | 継続課金(定期・従量) 購入要求 ST01-00104-402 | 継続課金(定期・従量) ユーザー情報画面 「購入」 |

| 継続課金(定期・従量)解約 | 継続課金(定期・従量) 申込要求 D01-1 | 継続課金(定期・従量) 解約要求 ST02-00309-402 | 継続課金(定期・従量) ユーザー情報画面 「解除」 |

注意事項

エンドユーザーの状態による挙動

売上要求処理、継続課金(簡易)や継続課金(定期従量)の確定処理、取消・返金処理等を行った際に、利用されたエンドユーザーがau、Uqmobile携帯電話を解約しているなど処理不可能な状態の場合、エラーが返却され処理不可能となります。この場合、課金および返金ができなくなりますのでご注意ください。

※処理不可時においては、加盟店にてエンドユーザーへの対応を検討下さい。

継続課金(定期従量)の用途

継続課金(定期従量)は都度課金に利用できませんので、ご注意ください。また、ユーザー認証を省略したい等の理由による利用も禁止となります。

継続課金(定期従量)の決済リクエストの必須タグエレメントについて

「商品名称(item_name)」に「商品(サービス)内容※1」と「課金タイミング※2」を設定してください。

また、エンドユーザーが申込みされた商品の認識ができず、勝手に課金されたとクレームになることがありますので、加盟店サービスサイトにて認識できる商品名称を設定してください。

なお、商品名称(item_name/全角20文字以内※3)設定内容は、au PAY(auかんたん決済)の決済画面(摘要欄)およびユーザマイページに表示されます。

※1:ワイン3,000円分お届けコース等

※2:毎月20日課金、毎週金曜日課金等

※3:KDDI画面での表示は全角16文字までとなります(16文字を超えた分は切れた状態で表示)

継続課金(定期従量)の解約手続きについて

エンドユーザーが契約中の商品名、課金予定日や解約導線を確認できるマイページ等をご準備ください。エンドユーザーにとってわかりやすい上位階層に解約手続き画面を設定してください。

継続課金(定期従量)のエラー時の対応について

物品販売時に利用限度額エラー(売上確定エラー)となった場合、次回以降の継続課金は停止される旨エンドユーザーへの通知をご検討ください。

またエラーとなった際、他の支払い方法への誘導や、次回以降の支払い方法について確認ができるようエンドユーザーへご配慮ください。

当社経由でau PAY(auかんたん決済)利用時の機能の違い

au PAY(auかんたん決済)を利用する場合、当社がau PAY(auかんたん決済)の各種I/F仕様や追加決済手段別の仕様差異を、当社の標準決済機能として組み込んで提供します。そのため、加盟店は、エンドユーザーが実際に利用した決済手段を気にすることなく、決済システムの接続や決済処理の管理をすることができます。

※一部機能に関しては、機能が制限される場合がありますのでご注意ください。

- KDDI提供のWeb管理画面について

KDDI提供のWeb管理画面は利用できません。当社が提供する決済管理ツールを用いて決済情報の管理を行ってください。 - OpenID連携について

当社が提供する決済ASPのI/Fで連携する「顧客ID」とau IDに紐づいたOpenIDを当社が紐付けて管理することで、2回目以降のau PAY(auかんたん決済)のログイン画面を省略することができます。連携対象の顧客IDは利用するエンドユーザー毎に一意である必要がありますので、留意ください。 - 追加決済手段の組み合わせによる仕様の違い

追加決済手段を利用の場合、一部の機能が制限されます。

以下の表を理解のうえ、追加決済手段を選択するようにお願いします。

決済手段の判別

当社が提供する決済管理ツールでは、支払いに利用された決済手段を区別することなく「au PAY(auかんたん決済)」で管理します。

| 支払手段別の組み合わせ | 商材 | 売上方式 | 課金方式 | 機能 | ||||

|---|---|---|---|---|---|---|---|---|

| 物販 | デジコン | 自動売上 | 指定売上 | 都度課金 | 継続課金 (簡易) | 継続課金 (定期従量) | 返金 | |

| 基本※1 | ○ | ○ | ○ | ○ | ○ | ○※2 | ○※3 | ○ |

| 基本※1+クレジットカード | ○ | ○ | ○ | ○ | ○ | ○ | × | ○ |

※1:基本とは、通話料合算、au PAY プリペイドカード、au PAYカードの組み合わせを指します。

※2:au PAY プリペイドカードを除きます。

※3:au PAY プリペイドカード、au PAY カードを除きます。

支払期限設定

エンドユーザーは、支払期限より前に支払いを開始していれば、支払期限を超えても支払いが可能です。ただし、支払開始から完了するまでの期限は4分となります。

返金可能期間

返金処理開始可能時期当日の返金処理は、タイミングにより返金エラーとなる場合があります(課金処理後に返金が可能となる為)。その際は時間をおいて再度返金処理を行って下さい。

不正利用調査およびチャージバック

エンドユーザーから商品不備や利用覚え無しなどの申し出や、第三者による不正利用の疑いなどにより、KDDIから不正利用調査およびチャージバック(債権買取拒否)が発生する場合があります。当社がKDDIから連絡を受けた場合、速やかに加盟店に状況を連絡しますので、連絡内容に沿って対応ください。なお、チャージバックが確定した場合、当該売上金額は精算対象外となり、加盟店負担となります。詳しくは、申込時に提供する重要事項説明書を参照ください。

追加の決済手段でクレジットカード払いを利用の場合、当社を経由することなく直接カード会社またはKDDI提携の決済代行会社から連絡が入る場合もありますのでご了承ください。

仕様について

au PAY(auかんたん決済)は、KDDIが提供するサービスをオンライン決済ASPに組み込み提供しています。KDDIにて仕様変更や経済条件の変更等を行った場合は、それに伴い当社が提供するau PAY(auかんたん決済)の仕様も変更となる場合がありますのでご了承ください。

メンテナンス等によるサービス停止

オンライン決済ASPは、不定期にメンテナンスを行います。メンテナンスによるサービス停止がある場合はあらかじめ通知のうえ、サービス停止します。1週間前までに通知することを基本としています。ただし、緊急メンテナンスによる場合はその限りではありません。

また、当社のシステム以外で、KDDIやKDDI提携先等のシステムメンテナンスや不具合によるサービス停止が発生した場合、状況がわかり次第、速やかに加盟店に通知のうえ、原因究明をします。原因判明でき次第、加盟店に通知するようにしますが、当社に起因しない場合、原因判明に時間がかかる場合があることを予めご了承ください。

補足情報

エンドユーザーから加盟店へ「au PAY(auかんたん決済)を利用できない」などのお問合せがあった場合

よくある理由として以下をお伝えください。

- 利用限度額オーバー

- 料金滞納がないか

- エンドユーザー自身で利用制限を行っていないか

※上記確認し、納得頂けない場合は、KDDIに誘導してください。