Online Payment ASP Service

Types of Payments Handled

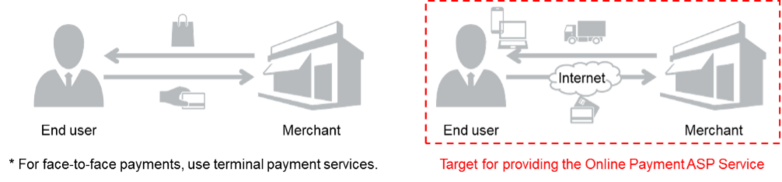

Payments can be broadly divided into two types: "face-to-face payment" and "non-face-to-face payment." The Online Payment ASP Service provides payment agency services for "non-face-to-face payments."

Face-to-face payment

A payment made when an end user visits a real shop and purchases an item or service. Examples: department store, supermarket, and restaurant

Non-face-to-face payment

A payment made when an end user purchases an item or service through the Internet or phone. Examples: online supermarket and digital distribution

Service Overview

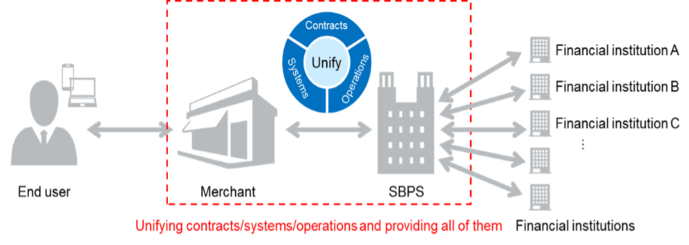

The Online Payment ASP Service provides a merchant's site with the whole contracts/systems/operations necessary for introducing online payment functions (except some payment methods). For details, see Service Specifications for each service.

Online Payment ASP Service

Unification of contracts

You can use various payment methods by just applying to SBPS. Negotiations/contracts between each financial institution such as a credit card company and a merchant are generally unnecessary.

Unification of systems

Various payment methods can be used through a common interface. Therefore, addition of payment methods can easily be conducted.

Unification of tasks

Even when you use multiple payment methods, SBPS collects all proceeds. Also, you can use the Payment Management Tool which allows you to perform settlement aggregations and refund processing.

Payment Process

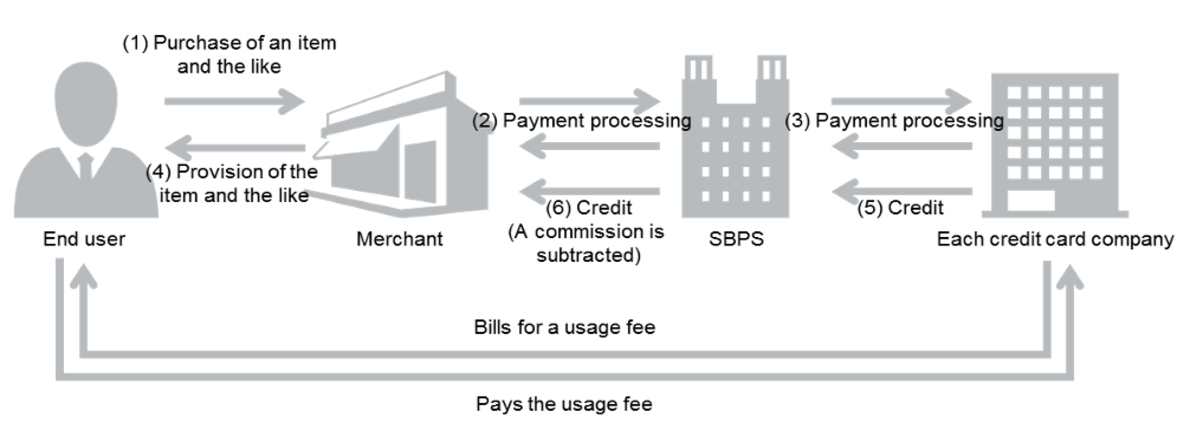

When the Online Payment ASP Service is introduced, SBPS intermediates between the merchant and financial institutions and acts for the merchant in processes regarding payments and credits.

Example: When an end user purchases an item at the merchant site with a credit card

- An end user purchases an item at the merchant site with a credit card.

- The Merchant requests SBPS to carry out the payment processing, and then waits for SBPS to return the payment result.

- SBPS requests the credit card company to conduct payment processing, receives the payment result, and then returns it to the merchant.

- The Merchant delivers the item to the end user.

- The credit card company credits the usage fee to SBPS.

- SBPS transfers the usage fee to the Merchant.

* Billing/payment between the end user and the financial institution are conducted at the time prescribed by the end user agreement or the like issued by the credit card company.

Billing method

The provided billing methods are as follows. Incidentally, obtain an agreement from an end user on the billing that occurs recurrently in advance before using recurring billing (simplified) and recurring billing (fixed term/pay-as-you-go).

| Billing method | Description |

|---|---|

| One-time charge | One-time billing |

| Recurring charge (simple) | Bills a fixed amount of money on the billing date (start of month) prescribed by SBPS. |

| Recurring charge (based on term or usage rate) | The merchant specifies the billing date and amount of money to bill. |

One-time charge

This billing method conducts a payment each time an end user uses.

<<Available payment methods>>

The one-time billing is available for all payment methods except account transfer services. For information on account transfer services, see the Service Specifications (Account Transfer Service).

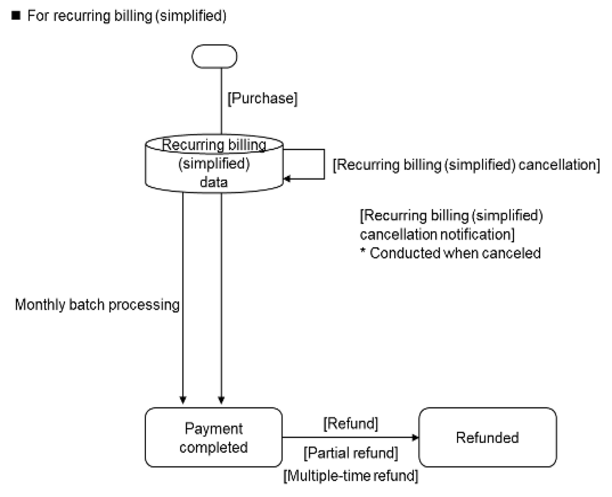

Recurring charge (simple)

This billing method conducts a payment of a fixed amount of money on a billing date at the start of every month as prescribed by SBPS. A payment is automatically made every month through a payment method specified by an end user. For details, see the Service Specifications (Recurring Billing (Simplified)).

<<Features>>

- This service supports advance payment, monthly closure, and billing of fixed amount.

- Merchants can specify whether to charge for the first month or not, whether to charge at the time of a cancellation in the first month or not, and the final month for which the billing is made.

- Merchants are not required to perform the monthly billing processing.

<<Available payment methods>>

Recurring billing (simplified) is available for the payment methods below.

| Credit Card Payment | d Payment | au PAY(au Kantan Kessai (Easy Payment)) |

| Recruit Kantan Shiharai |

Recurring charge (based on term or usage rate)

Through this billing method, the merchant specifies the desired time and amount of money to conduct payments recurrently. A payment is made through processing of the merchant with a payment method specified by an end user. For details, see the Service Specifications (Recurring Billing (Fixed Term/Pay-as-You-Go)).

<<Features>>

- This billing method is suited to periodic purchase at the time the merchant desires.

- The amount of money can be specified or changed.

- The merchant needs to conduct billing processing for each billing.

<<Available payment methods>>

Recurring billing (fixed term/pay-as-you-go) is available for the payment methods below.

| SoftBank Matomete Shiharai (B) | d Payment | au PAY(au Kantan Kessai (Easy Payment)) |

| Rakuten Pay (Online Payment) | Recruit Kantan Shiharai | PayPay (Online Payment) |

| Amazon Pay | Rakuten Pay (Online Payment)V2 |

Close authorization settlement

The provided settlement methods are as follows.

| Close authorization settlement | Description |

|---|---|

| Auto close authorization capture method | A capture is made at the time of an end user's purchase. |

| Specified close authorization capture method | A capture is made at a time specified by the merchant. |

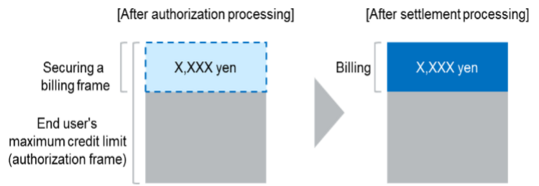

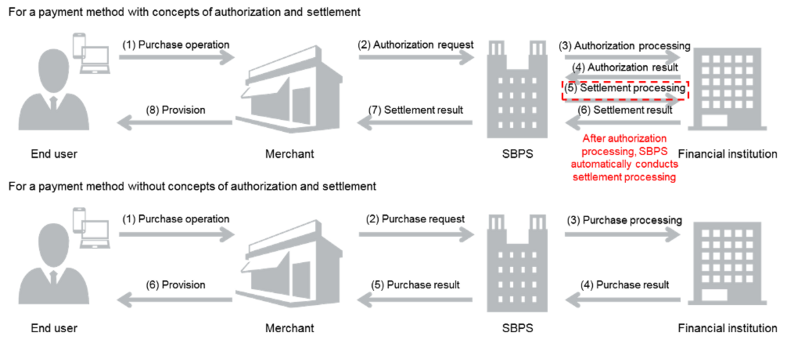

About Authorization and Settlement

On some payment methods such as credit card payments, it is necessary to secure a frame for the payment amount from the end user's maximum credit limit at the time of payment (authorization processing). When such a payment method with concepts of authorization and settlement is used, authorization processing and settlement processing need to be conducted.

<<What is authorization processing?>>

Authorization processing is to request a financial institution to secure a billing frame for a usage fee. The end user is not billed for the usage fee and it is not credited to the merchant just by conducting authorization processing.

<<What is settlement processing?>>

Settlement processing is to make a request to a financial institution for settlement for a usage fee. When settlement processing is conducted, the end user is billed for the usage fee.

Image of Authorization Processing and Settlement Processing

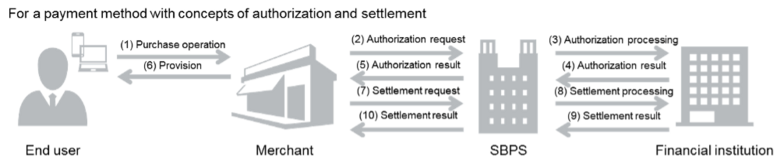

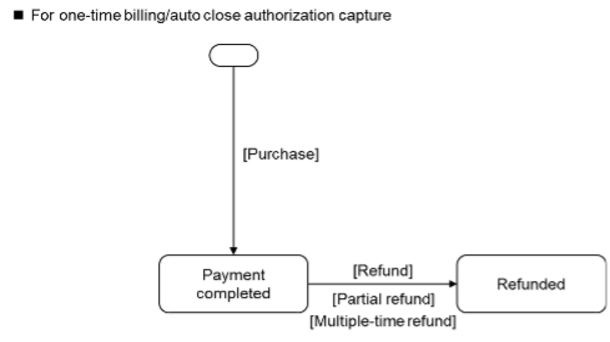

Auto close authorization capture method

This method immediately makes a capture at the time of an end user's purchase. When a payment method with concepts of authorization and settlement is used, settlement processing by the merchant is not necessary because SBPS conducts settlement processing after authorization processing.

<<Usage Overview>>

<<Available payment methods>>

The auto close authorization capture method is available for all payment methods except account transfers and NP Deferred Payment.

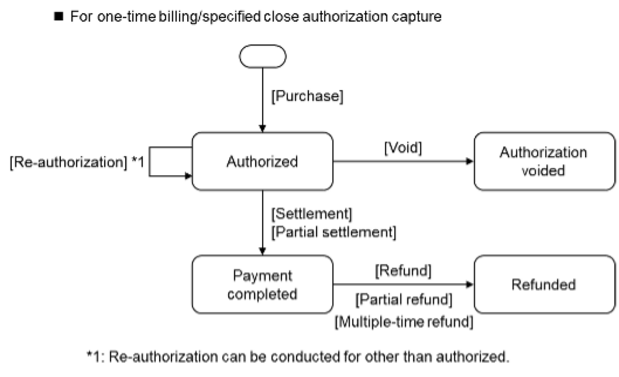

Specified close authorization capture method

When a payment method with concepts of authorization and settlement is used, this method conducts settlement processing at a time specified by the merchant. This method is suited when you want to make a capture at the time of the shipment to the end user for product sales or the like.

<<Usage Overview>>

<<Available payment methods>>

Available payment methods are as follows.

| Credit Card Payment | SoftBank Matomete Shiharai (B) | d Payment |

| au PAY(au Kantan Kessai (Easy Payment)) | Rakuten Pay (Online Payment) | Recruit Kantan Shiharai |

| Apple Pay | Google Pay | Wallet payment service (Type-Y) |

| NP Atobarai | PayPay (Online Payment) | Merpay Online Payment |

| Amazon Pay | EPOS Kantan Kessai Service | au PAY (Online Payment) |

| Rakuten Pay (Online Payment)V2 |

system connection method

The system connection methods are as follow.

| system connection method | Description |

|---|---|

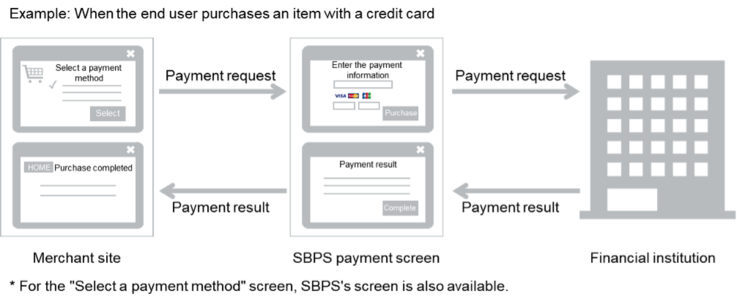

| Link Type | Through this method, the merchant displays SBPS's payment screens in order for end users to enter payment information for processing. SBPS provides payment procedure screens. |

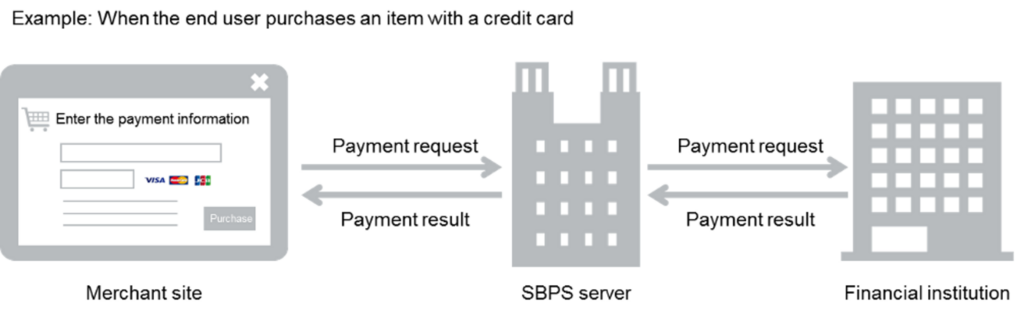

| API Type | Through this method, the merchant obtains payment information and has it processed with server-to-server transactions. The merchant can freely customize payment procedure screens. |

Comparison between Link Type and API Type

| Merit/demerit | Link Type | API Type |

|---|---|---|

| Flexibility of customization of payment screens | ○ (Optional service) | ○ |

| Flexibility of designs of payment processing flows | △ | ○ |

| Flexibility of development languages of merchant sites | ○ | ○ |

| Facility of development of merchant sites | ○ | △ |

| Availability of the Payment Management Tool | ○ | ○ |

| Facility of addition of payment methods | ○ | △ |

| Amplitude of available payment methods | ○ | △ |

| Non-passage of credit card information | ○ | 〇※1 |

Link Type

<<Features>>

- Since SBPS provides payment screens, the merchant does not need to prepare screens.

- There are ample supported payment methods.

- Since interfaces are common to each payment method, payment methods can be easily added.

<<Usage Overview>>

<<Fee-based optional services>>

The following optional services are provided for the link type.

- Customization of payment screen designs (PC site only) is available.

- Payment screens can be used through the merchant's own domain.

- Screens optimized for smartphones are provided.

<<Available payment methods>>

Available for all payment methods.

API Type

<<Features>>

- Since the merchant can design payment screens, designs and transitions can be freely customized.

- Various functions can be used by combining each API in accordance with operations of the merchant.

- Since various functions are provided, cooperation with merchant's systems other than the payment system can be performed.

<<Usage Overview>>

<<Available payment methods>>

Purchase processing is available with the API type through the following payment methods.

| Credit Card Payment | JCB PREMO payment | Web convenience store payment |

| Pay-easy payment | General wire transfer (bank-to-bank wire transfer) payment | Apple Pay |

| Google Pay | NP Atobarai | Amazon Pay |

Subsequent processes after purchase processing such as capture, deposit receipt notification, cancellation, and refund are available with the API type through the following payment methods.

| Credit Card Payment | UnionPay Net Payment | SoftBank Matomete Shiharai (B) |

| d Payment | au PAY(au Kantan Kessai (Easy Payment)) | JCB PREMO payment |

| Wallet payment service (Type-Y) | Rakuten Pay (Online Payment) | Recruit Kantan Shiharai |

| PayPal Payment | Eikyu Fumetsu Point Payment | Web convenience store payment |

| Pay-easy payment | General wire transfer (bank-to-bank wire transfer) payment | Account transfer service |

| NP Atobarai | T-point program (online payment) | Apple Pay |

| Google Pay | Alipay Cross-border Payment | PayPay (Online Payment) |

| Merpay Online Payment | Amazon Pay | EPOS Kantan Kessai Service |

| au PAY (Online Payment) | Rakuten Pay (Online Payment)V2 |

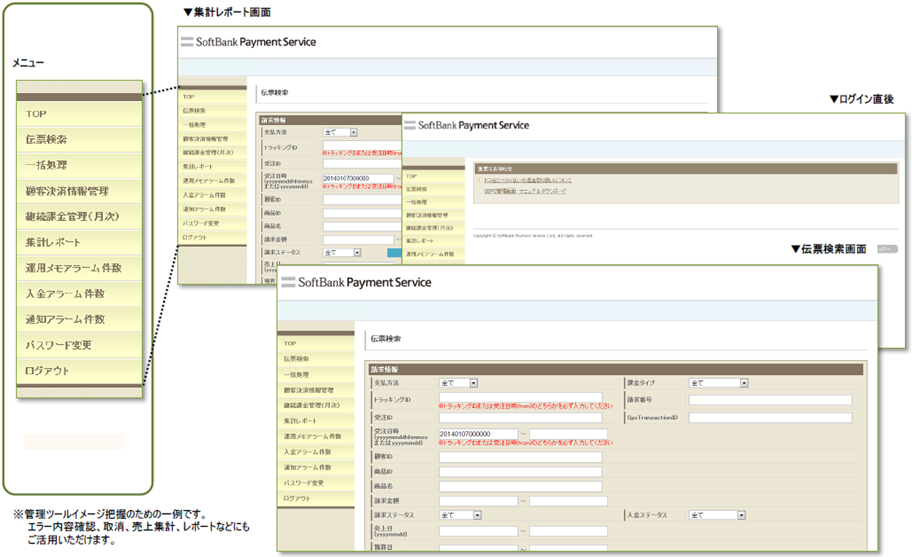

Payment management tool

The Online Payment ASP Service provides the Payment Management Tool that allows you to easily perform settlement aggregations and refund processes after introduction. For how to operate the Payment Management Tool, see the Payment Management Tool Manual.

Major Functions

Major functions are as follows:

- Searching/viewing the payment history

- Downloading displayed items into CSV files

- Various processes after payment such as "cancellation," "refund," "capture," and "cancellation of recurring billing."

- Displaying aggregation reports such as settlement, billing, and credit

Usage Overview

Provided functions

The main features of Online Payment ASP Service are as follows: The features available for each payment methods are different, so please refer to the service overview for each payment methods.

* Note: Functions of the payment administration tool are not shown here. Refer to the Payment Administration Tool Manual.

| Provided function name | Description |

|---|---|

| Purchase | A function for making the payment of the purchased item. When the specified close authorization capture method is used, this function obtains authorization and the settlement function needs to be performed. |

| Settlement | When the specified close authorization capture method is used, this function bills for all amounts of transactions after authorization. This function is used at the time the merchant desires. Unless settlement is conducted, the end user is not billed for usage fees and they are not credited to the merchant. |

| Partial Settlement | When the specified close authorization capture method is used, this function bills an end user for a specified amount that you want to bill. * The billing amount is within the amount of obtained authorization. |

| Cancellation | When the specified close authorization capture method is used, this function cancels a transaction after authorization. Use Refund for a transaction after settlement. |

| Refund | A function for making a full refund of a transaction after settlement. Use Cancellation for a transaction before settlement. |

| Partial Refund | This function refunds a specified amount you want to refund for a transaction after settlement. This function can be used only once. |

| Multiple Refunds | This function allows specifying an amount you want to refund and refunding the specified amount multiple times for a transaction after settlement. This function can be used multiple times until the usage fee becomes 0 yen. |

| Amount change | This function allows specifying a desired amount to change to that amount for a transaction after authorization or settlement. * It can change beyond the range of the amount of obtained authorization and the amount of settlement. |

| Re-obtained authorization | This function uses past payment information to obtain authorization as another payment. This function is used when settlement cannot be conducted within the authorization period or the like. |

| Payment result reference | A function for checking the payment status. |

| Deposit notification | This function notifies the merchant that an end user has made a payment through an offline method (convenience store payment, transfer, and so on). |

| Overdue payment cancellation notification | This function notifies the merchant that a transaction is canceled due to overdue offline payment (such as convenience store payment). |

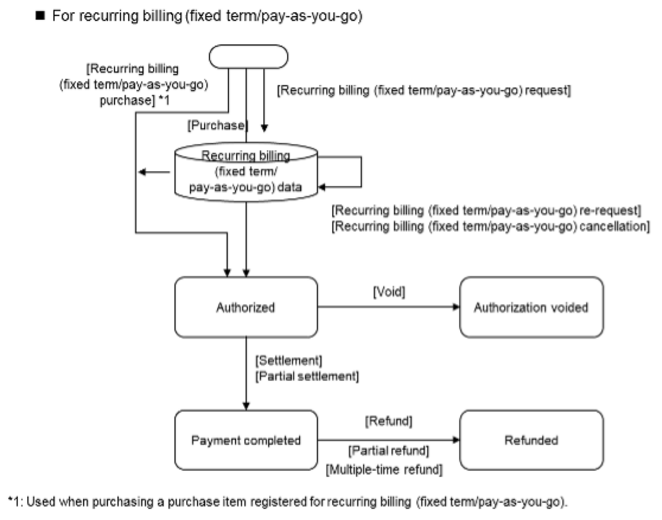

| Cancellation of recurring billing (simplified) | This function cancels a registration of recurring billing (simplified). Billing is not conducted after the cancellation. |

| Recurring billing (simplified) cancellation notification | This function notifies the merchant about a transaction that cannot be billed for. Billing is not conducted after the cancellation notification. |

| Recurring Billing (Fixed Term/Pay as You Go) Request | This function makes a request for a purchase item provided through recurring billing (fixed term/pay-as-you-go). This function only registers for the recurring billing (fixed term/pay-as-you-go) and does not bill. |

| Recurring billing (fixed term/pay as you go) re-request | This function changes a billing amount registered for recurring billing (fixed term/pay-as-you-go). |

| Recurring Billing (Fixed Term/Pay as You Go) Purchase | This function conducts a payment of a purchase item provided through recurring billing (fixed term/pay-as-you-go). |

| Recurring Billing (Fixed Term/Pay as You Go) Unsubscribing | This function cancels a registration of recurring billing (fixed term/pay-as-you-go). |

Usage Overview of Major Provided Functions

The main features provided are Transition Payment status as follows. For details on how to perform each function, refer to the connection method "Link Type", "API type", and "SBPS Admin portal / Payment management tool Function Manual".

* Since status names are general names, they may not be consistent with status names of the Payment Management Tool.

* Functions unique to some payment methods are omitted.

Online Payment ASP Service Environment

The Online Payment ASP Service provides a test environment and a production environment. Use the test environment for introduction and modification, and when releasing, switch to the connection target for the production environment and use it. However, note that the test environment may be out of service without prior notification due to SBPS's circumstances such as a maintenance.

* After you make an application and vetting is complete, we will provide the special test environment and production environment.

Usage Overview

System Requirements

System requirements of the Online Payment ASP Service are as follows. Incidentally, since use performance do not guarantee all functionalities, please check at the merchant as necessary.

| Supported browser | Browsers that support JavaScript and cookies <<Actual uses>>

|

|---|---|

| Supported OS | <<Actual uses>>

|

| Communication/network |

|

Steps Before You Can Use the Payment Service

You can see the process between applying and beginning service usage in the Support Site Manual.

Settlement Rules

Types of Fees

Fee items related to settlement are as follows.

| Field | Description | Remarks |

|---|---|---|

| Initial fee | The cost of various procedures, including environment-related setup. This fee is incurred the month that service begins. | – |

| Fixed monthly fee | The fixed monthly operating cost. This fee is incurred every month from the month that service begins. | A calculation on a daily prorated basis is not conducted. |

| Payment fee | A fee for the payment processing of the purchase money of an item or service. | |

| Payment service use fee | Commission for using the Online Payment ASP Service. | |

| Transaction fee | A fee for the system processing. |

* Other fees may be charged in addition to the fees shown above. For details, check upon application.

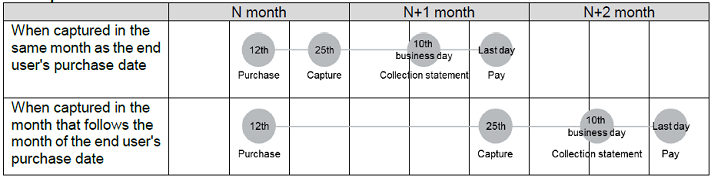

Settlements

Using the date of settlement as the calculation base, the settlement processing results and amounts of money from the first day to the end day are summed, and the receipt statement is sent by the 10th business day of the month of settlement (or by 21st of the next month depending on the used payment method). The proceeds from sales are transferred to the specified bank account at the end of the next month of the month of settlement (the end of the month in which the receipt statement is sent).

Example Settlement Flows

Notes

| Field | Description |

|---|---|

| Settlement cycle |

|

| Billing method |

|

| Check of transfer information |

|

| Receipt statement |

|

| Other |

Cutoff from 1st to 15th: Paid at the end of the month Cutoff from 16th to the last day: Paid on 15th of the next month <<Date for sending a collection statement>> Sent by the previous date of credit |

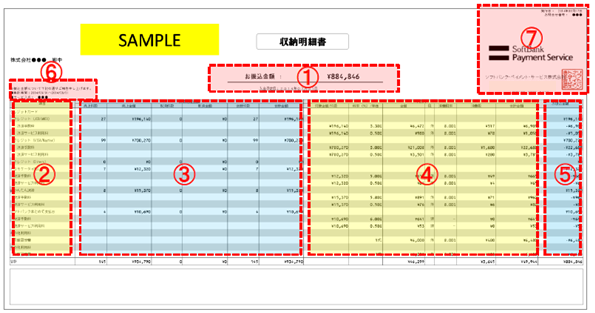

Receipt statement image

| Shown item | Description |

|---|---|

| (1) Total amount of settlement and date of transfer | The amount transferred to the specified account, and the date of transfer. * (5) The total of settlement amounts of all the fee items. |

| (2) Fee item | Fee items for the introduced payment methods and options (including the installation fees). |

| (3) Amounts of payment processing | The number and amount of settlements of each fee item, number and amount of refunds, and total number and amount. |

| (4) Fees | The settlements for charging a fee for each fee item and number of them, unit price of fee, and the total amount of fees including the consumption tax. |

| (5) Settlement amount | Settlement amount of each fee item. (A bill is sent when the amount is negative.) * (3) Total amounts of payment processing - (4) total amounts of fees |

| (6) Summing period and service name | The target payment processing period and service name of the receipt statement. * A receipt statement showing the summing period and service name is sent for each service ID (SID). |

| (7) Query number | A query number to be used for inquiring of SBPS. |

* The tax class (taxable/non-taxable/untaxable) varies with the payment method.

* Note that the shown items and design may change.

Definitions of Terms

For definitions of terms, refer to the Glossary.

| Term | Synonyms | Definition |

|---|---|---|

| Merchant | You, company | A company that has contracted to use SBPS's Online Payment ASP Service |

| End user | End user, user, customer | The user of the Merchant's service. |

| Financial institution | Financial Institution | A company that provides payment services via SBPS's Online Payment ASP Service |

| Collection company | Collection institution | A company that collects usage fees paid through convenience stores or the like substituting for financial institutions |

| Brand | International brand, domestic brand | A company that operates a payment network in which credit cards can be used |

| Device | Terminal | A device to access websites. |

| Payment | Settlement, payment | Interchange of money between a Merchant and an end user through a trade transaction. |

| Payment method | Payment method | A method for paying the purchase money of an item or service. |

| Payment status | – | A payment state of a transaction |

| Payment processing | – | Transmission and acceptance of payment information conducted by a system. |

| Billing processing | – | To bill for the purchase money of an item or service. |

| PCI DSS | – | A security standard of the credit card industry which was jointly created by credit card companies to handle credit card members' data securely |

| Chargeback | – | A credit card company cancels a settlement of a usage fee when a holder of a credit card does not agree to a payment of the usage fee due to a fraudulent transaction and so on; this cancellation is referred to as chargeback |

| Regulation | – | Usage regulations stipulated by a financial institution intending for Merchants. |

| Acceptance mark | – | A mark that indicates that a payment method is available. |

| API | – | Stands for Application Programming Interface. A set of commands, rules, functions, etc. that can be used when programming. |

| Interface | IF, interface | Stands for Interface. A device or software to connect different systems to each other. |

| CSS | – | An abbreviation for Cascading Style Sheet. This is one of the languages constructing website pages on the Internet and used for page layout and so on |

| SSL communication | – | Stands for Secure Sockets Layer. A technology to encrypt information sent and received via the Internet. |