サービス概要

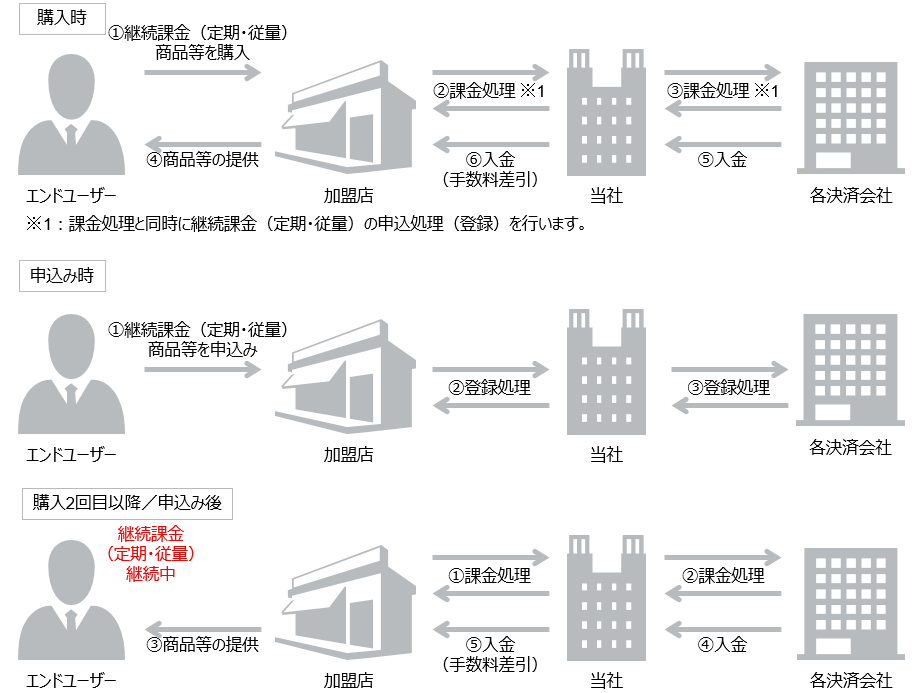

継続課金(定期・従量)とは、加盟店が任意のタイミングおよび指定の金額で継続的に決済する課金方式です。エンドユーザーが指定した決済手段で加盟店処理により決済します。

エンドユーザーは、初回時に購入または申込みを行います。2回目以降は、登録済み決済情報を利用して課金を行います。本課金方式を利用する際は、予めエンドユーザーに対して継続的に課金することや金額についての同意を取得したうえで、利用ください。

※当社が別途提供している継続課金(簡易)とは異なる課金方式となりますのでご注意ください。

※PayPay(オンライン決済)の場合は初回時には申込しかできなく、同時に購入できませんので、ご注意ください。

サービス概念図

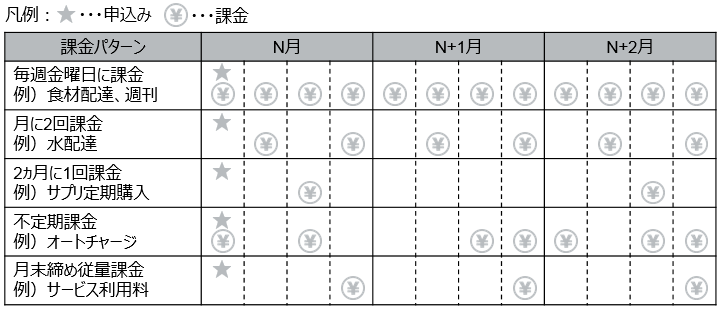

《課金パターンの例》

主な特徴

- 指定の日付や期間での定期購入に適しています。

- 金額の指定や変更ができます。

- 加盟店は月次の課金処理が必要です。

利用可能な決済手段

以下の決済手段で継続課金(定期・従量)を利用可能です。

| ソフトバンクまとめて支払い(B) | d払い | au PAY(auかんたん決済) |

| 楽天ペイ(オンライン決済) | リクルートかんたん支払い | PayPay(オンライン決済) |

| Amazon Pay | 楽天ペイ(オンライン決済)V2 |

サービス仕様

基本仕様

継続課金(定期・従量)に関する決済手段別の基本仕様について、以下に記載します。決済管理ツールで行う売上確定や取消などの各種処理期間は、決済管理ツールに従います。

基本仕様

| 決済手段 | 項目 | 仕様 | |

|---|---|---|---|

| ソフトバンクまとめて支払い(B) | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む60日後まで | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む60日後まで | ||

| 返金可能期間 | 売上確定日を含む400日後まで ※クレジットカード払いの場合、返金可能期限はクレジットカード会社によって異なります。 | ||

| 最終課金処理日からの継続課金の有効期限 | 無し | ||

| d払い | 売上方式 | 自動売上 | ○ d払い(キャリア)のみ利用可能 |

| 指定売上 | ○ d払い(ウォレット)のみ利用可能 | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 自動売上の場合:売上確定不要 指定売上の場合:購入要求処理日を含む翌々月末20時まで | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 自動売上の場合:取消機能無し 指定売上の場合:購入要求処理日を含む翌々月末20時まで | ||

| 返金可能期間 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む翌々月末20時まで | ||

| 最終課金処理日からの継続課金の有効期限 | 13ヵ月を目安にドコモの判断により決定 | ||

| au PAY(auかんたん決済) | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日から90日以内 | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む90日後まで | ||

| 返金可能期間 | 売上確定処理日を含む翌々月末まで | ||

| 最終課金処理日からの継続課金の有効期限 | 365日 | ||

| 楽天ペイ(オンライン決済) | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 購入要求処理月、または継続課金(定期・従量)購入要求処理月を含む5ヵ月後の末日まで ※クレジットカードの与信期限は与信から60日有効です。 与信期限切れの決済に対し売上確定処理を行った場合は、楽天側で再与信・確定処理を実行します。 | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 購入要求処理月、または継続課金(定期・従量)購入要求処理月を含む5ヵ月後の末日まで | ||

| 返金可能期間 | 売上確定処理日を含む翌月末まで | ||

| 金額変更※楽天ペイ(オンライン決済)のみ | 売上確定処理前の場合:購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む5ヵ月後の末日まで 売上確定処理後の場合:売上確定処理日を含む翌月末まで | ||

| 最終課金処理日からの継続課金の有効期限 | 24ヵ月 ※登録済みクレジットカードの有効期限が切れた場合は、NGとなります。 | ||

| リクルートかんたん支払い | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 継続課金処理(与信) | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 購入要求処理日、または継続課金(定期・従量)購入要求処理日を含む30日後まで ※申込み時に申請することで最大60日後まで延長することが可能です。 | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 購入要求処理日、または継続課金(定期・従量)購入要求処理の翌月末まで | ||

| 返金可能期間 | 売上確定処理日の翌月末まで | ||

| 最終課金処理日からの継続課金の有効期限 | 24ヵ月 ※登録済みクレジットカードの有効期限が切れた場合は、NGとなります。 | ||

| PayPay(オンライン決済) | 売上方式 | 自動売上 | ○ |

| 指定売上 | × | ||

| 継続課金処理 | 加盟店にて課金処理を実施※ 当社で課金処理は行いません。 | ||

| 売上確定期限 | 自動売上のため売上確定不要 | ||

| 課金処理不可通知日 | 無し | ||

| 取消可能期間 | 自動売上のため無し ※プッシュ課金取消において、支払期限内、且つエンドユーザーまだ同意されない場合いつでも取消できます。 | ||

| 返金可能期間 | 決済日翌日を一日目として、365日 | ||

| 最終決済処理日からの継続課金の有効期限 | 365日 | ||

| Amazon Pay | 売上方式 | 自動売上 | × |

| 指定売上 | 〇 | ||

| 継続課金処理 | 加盟店にて課金処理を実施 ※当社で課金処理は行いません。 | ||

| 売上確定期限 | 初回:「Session更新」処理日時から30日後まで 2回目以降:「継続課金(定期・従量)購入」処理日時から30日後まで | ||

| 取消可能期間 | 初回:「Session更新」処理日時から30日後まで 2回目以降:「継続課金(定期・従量)購入」処理日時から30日後まで | ||

| 返金可能期間 | 制限なし | ||

| 楽天ペイ(オンライン決済)V2 | 売上方式 | 自動売上 | × |

| 指定売上 | ○ | ||

| 売上確定期限 | 購入要求処理日時/継続課金(定期・従量)購入または金額変更の最終実施日時から30日後まで かつ 購入(または継続課金(定期・従量)購入)要求処理日時から365日後まで※4 | ||

| 取消可能期間 | 購入(または継続課金(定期・従量)購入)要求処理日時から365日後まで※4 | ||

| 返金可能期間 | 売上確定処理日時から30日後まで かつ 購入(または継続課金(定期・従量)購入)要求処理日時から365日後まで※4 | ||

| 金額変更期限 | 売上確定前の場合:購入要求処理日時/継続課金(定期・従量)購入処理日時または金額変更の最終実施日時から30日後まで かつ 購入(または継続課金(定期・従量)購入)要求処理日時から365日後まで※4 売上確定後の場合:売上確定処理日時から30日後まで かつ 購入(または継続課金(定期・従量)購入)要求処理日時から365日後まで※4 | ||

| 金額変更可能回数 | 金額変更に回数制限はありません | ||

デビットカードは、与信時に即時口座から引き落としになります。与信から売上確定するまで30日以上の期間※1がある場合、与信金額が自動的にエンドユーザーの口座に返金される場合があります。エンドユーザーの口座に返金後、加盟店にて売上確定を行った結果、口座から引き落とせない場合、加盟店へのチャージバックとなる可能性があります。

※1:各デビットカード発行会社により異なります。

※2:購入から30日経過している注文に対して、出荷処理を行う際は、再度与信を取得してから確定するため、与信が取得できない可能性がございます。必ず、出荷、またはサービス提供前に売上要求処理を実施してください。

(ブランドルール改訂により、2021年10月より10日経過している注文に対して、再度与信を取得するよう変更予定です)

※3:目安として180日となります。

※4:詳細は楽天ペイ(オンライン決済)V2) サービス概要をご確認ください。

対応デバイス

継続課金(定期・従量)の申込もしくは申込同時購入の画面操作は、以下のデバイスで利用可能です。

| 決済手段 | PC | スマートフォン | 携帯 |

|---|---|---|---|

| ソフトバンクまとめて支払い(B) | ○ | ○ | × |

| d払い | ○ | ○ | × |

| au PAY(auかんたん決済) | ○ | ○ | × |

| 楽天ペイ(オンライン決済) | ○ | ○ | × |

| リクルートかんたん支払い | ○ | ○ | × |

| PayPay(オンライン決済) | ○ | ○ | × |

| Amazon Pay | ○ | ○ | × |

| 楽天ペイ(オンライン決済)V2 | ○ | ○ | × |

提供機能一覧

継続課金(定期・従量)では、以下の機能を提供しています。決済管理ツールの機能は、主な機能のみを記載しています。詳しくは決済管理ツールマニュアルにて確認ください。

| 決済手段 | 提供機能 | リンク型 | API型 | 決済管理ツール | |

|---|---|---|---|---|---|

| ソフトバンクまとめて支払い(B) | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 部分売上 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 返金 | – | ○ | ○ | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | – | – | ○ | ||

| d払い(キャリア) | 購入 | ○ | – | – | |

| 返金 | – | ○ | ○ | ||

| 部分返金 | – | ○ | ○ | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○※1 | ○※1 | ○※1 | ||

| d払い(ウォレット) | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 返金 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○※1 | ○※1 | ○※1 | ||

| au PAY(auかんたん決済) | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 部分売上 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 返金 | – | ○ | ○ | ||

| 部分返金 | – | ○※3 | ○※3 | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)再申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | ||

| 楽天ペイ(オンライン決済) | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 返金 | – | ○ | ○ | ||

| 金額変更 | – | – | ○※3 | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | ||

| リクルートかんたん支払い | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 部分売上 | – | ○ | ○ | ||

| 取消 | ○ | ○ | |||

| 返金 | – | ○ | ○ | ||

| 部分返金 | – | ○ | ○ | ||

| 複数回返金 | – | ○ | ○ | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | ||

| PayPay(オンライン決済) | 継続課金(定期・従量)申込 | ○ | – | – | |

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | ||

| ユーザー解約通知※4 | – | ○ | – | ||

| プッシュ課金購入 | – | ○ | ○ | ||

| プッシュ課金確定通知 | – | ○ | – | ||

| プッシュ課金取消 | – | ○ | – | ||

| 返金 | – | ○ | ○ | ||

| 部分返金※5 | – | ○ | ○ | ||

| 継続課金(定期・従量)申込状態参照※6 | – | ○ | – | ||

| 決済結果参照 | – | ○ | – | ||

| Amazon Pay | 住所支払情報取得 | – | ○ | – | |

| 注文 | – | ○ | – | ||

| Session更新 | – | ○ | – | ||

| 売上※7 | – | ○ | ○ | ||

| 部分売上※7※8 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 返金※9 | – | ○ | ○ | ||

| 部分返金※9 | – | ○ | ○ | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | – | ○ | ○ | ||

| 楽天ペイ(オンライン決済)V2 | 購入 | ○ | – | – | |

| 売上 | – | ○ | ○ | ||

| 取消 | – | ○ | ○ | ||

| 返金 | – | ○ | ○ | ||

| 金額変更 | – | ○ | ○ | ||

| 決済結果参照 | – | ○ | – | ||

| 継続課金(定期・従量)申込 | ○ | – | – | ||

| 継続課金(定期・従量)購入 | – | ○ | ○ | ||

| 継続課金(定期・従量)解約 | ○ | ○ | ○ | ||

※2:売上当月の部分返金はできません。

※3:金額変更は、購入された決済を一度取り消し、再購入処理を行います。そのため、以下の点にご注意ください。

- 金額変更要求処理を行った際に、エラーが返却され処理不可となる場合があります。この場合、変更前の元金額含め、課金処理自体ができなくなりますのでご注意ください。処理不可時は、加盟店にてエンドユーザーへの対応を検討ください。金額変更後は売上確定処理を行う必要があります。金額変更を行う場合は、事前にエンドユーザーに金額変更を行う旨を通知してください。

※4:エンドユーザーがPayPayアプリ側から継続課金(定期・従量)の解約ができます。解約後、本機能 で加盟店にその解約を通知します。

※5:部分返金の実施は1回のみ、複数回返金機能を提供していません。

※6:本機能で継続課金(定期・従量)の申込状態(申込中or解約済み)を参照できます。

※7:「Session更新」から7日を超えた場合は非同期処理のため、最終結果は遅れて通知します。詳細はAPI型 Amazon PayIF仕様の「売上要求」「決済結果通知」をご確認ください。

※8:部分売上の実施は1回のみです。

※9:非同期処理のため、最終結果は遅れて通知します。詳細はAPI型 Amazon PayIF仕様の「取消返金要求」「決済結果通知」をご確認ください。

提供機能概要

継続課金(定期・従量)で利用する独自機能の概要は以下のとおりです。

| 提供機能 | 機能概要 |

|---|---|

| 購入 | エンドユーザーが実際に画面で操作をして、継続課金の申込処理と同時に初回購入処理を行う機能です。 本機能により、継続課金管理用トラッキングIDを発行します。 ※継続課金(定期・従量)申込でトラッキングIDを発行する場合は、本機能は利用しません。 ※PayPay(オンライン決済)において、本機能を提供していません。 |

| 継続課金(定期・従量)申込 | 継続課金申込みの同意を取得し、登録処理を実施する機能です。 継続課金(定期・従量)の登録のみで課金は行いません。 本機能により、継続課金管理用トラッキングIDを発行します。 決済会社側の画面にてエンドユーザーが継続課金利用の同意をすることで、 継続課金(定期・従量)利用の決済会社側の承認を得られます。 |

| 継続課金(定期・従量)再申込 | 一度、申込み(登録)をした継続課金の金額、数量を変更する際に、 再度同意を取得する機能です。 |

| 継続課金(定期・従量)購入 | 登録済みのエンドユーザーに対して、課金処理を実施する機能です。 発行済み継続課金管理用トラッキングIDを用いて、課金処理を行います。 |

| 継続課金(定期・従量)解約 | エンドユーザーが実際に画面で操作をして、継続課金の申込状態を解約する機能です。 本機能により、継続課金管理用トラッキングIDを無効にします。 無効トラッキングIDを指定した継続課金はエラーとなります。 ※ソフトバンクまとめて支払い(B)は、解約機能がありません。 |

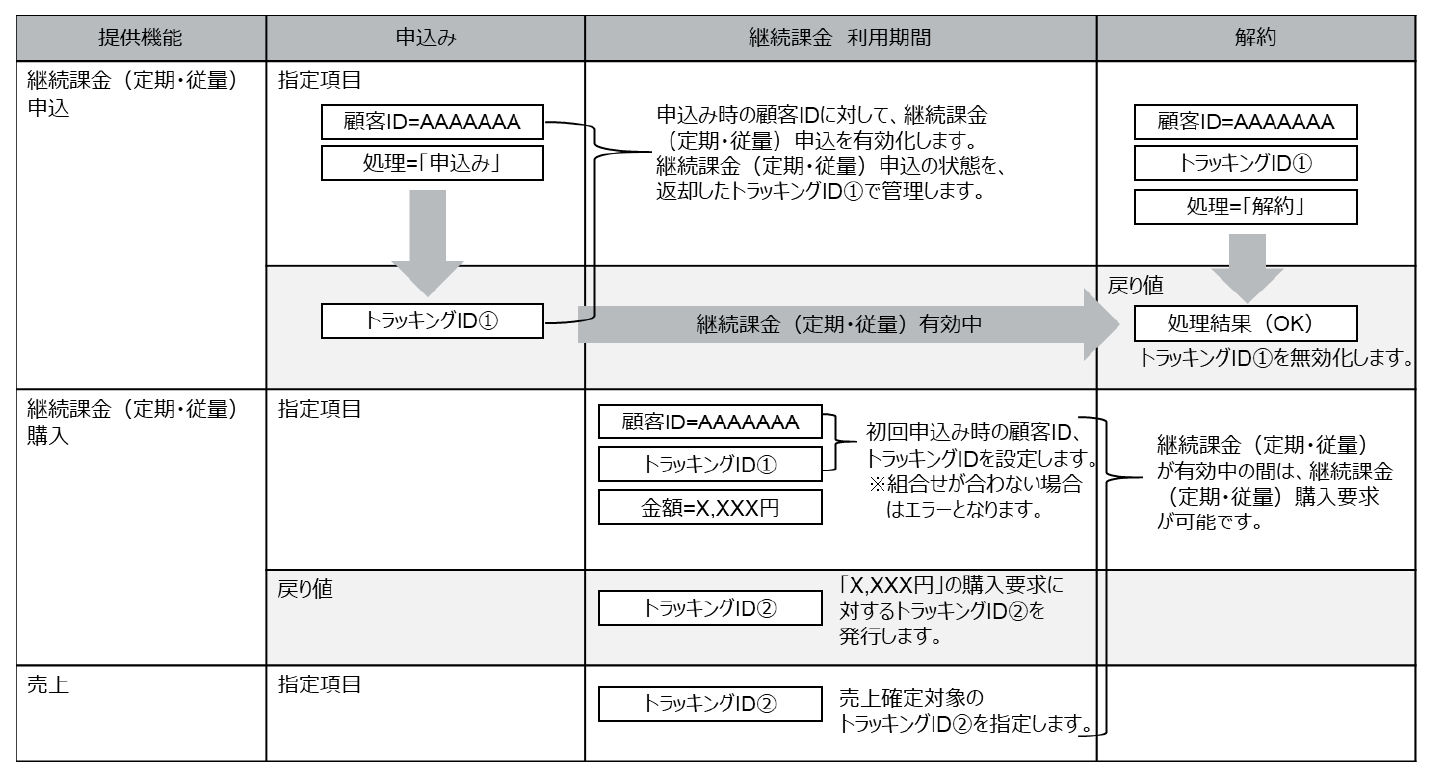

継続課金(定期・従量)の管理方法

継続課金(定期・従量)の有効状態は、申込みもしくは購入時に加盟店にて設定された「顧客ID」と、エンドユーザー承諾取得後に当社から返却される「トラッキングID」で管理します。次回以降の継続課金(定期・従量)購入要求処理時に、「顧客ID」と「トラッキングID」を指定することで、エンドユーザー同意済みとして、継続課金処理を行えるようになります。

継続課金管理イメージ(初回は、継続課金(定期・従量)申込を利用した場合)

※指定項目や戻り値の詳細は該当するIF仕様を参照ください。

注意事項

継続課金(定期・従量)の申込自動解除

以下の条件を満たす場合に、継続課金(定期・従量)の申込みが自動解除されます。自動解除された場合は、別の決済手段で再度申込みをお願いするなど、加盟店にて対応をお願いします。

| 決済手段 | 申込自動解除となる条件 |

|---|---|

| ソフトバンクまとめて支払い(B) | 登録した携帯電話自体が解約された場合 |

| d払い(キャリア) | 登録した携帯電話自体が解約された場合 |

| au PAY(auかんたん決済) | 登録した携帯電話自体が解約された場合 |

| 楽天ペイ(オンライン決済) | 登録したIDが解約(退会)されている場合 |

| リクルートかんたん支払い | 登録したIDが解約(退会)されている場合 |

| PayPay(オンライン決済) | 登録したアカウントが解約(退会)されている場合 |

| Amazon Pay | 登録したアカウントが解約(退会)されている場合 |

決済手段ごとの仕様差異

継続課金(定期・従量)では、決済手段ごとのI/Fの差異を可能な範囲で当社が吸収し、共通I/Fで利用できるようにしています。しかしながら、一部機能は決済会社が提供する機能・条件により、他決済手段と異なる仕様になっているため、加盟店にて機能差異を考慮して実装する必要があります。以下が決済手段ごとの仕様差異です。

チャージバック

商品不備等や利用覚え無しなどエンドユーザーからの申し出や、不正利用の疑いなどにより、決済会社から債権買取拒否(チャージバック)が発生する場合があります。当社が決済会社からの連絡を受けた場合、速やかに加盟店に状況ご連絡します。

決済会社による仕様変更

各決済会社が提供する決済サービスをオンライン決済ASPに組み込み提供しております。決済会社側にて仕様変更や経済条件の変更等を行った場合は、それに伴い当社が提供するオンライン決済ASPの仕様も変更となる場合がありますのでご了承ください。

メンテナンス

オンライン決済ASPは、不定期にメンテナンスを行います。メンテナンスによるサービス停止がある場合はあらかじめ通知のうえ、サービス停止します。1週間前までに通知することを基本としています。ただし、緊急メンテナンスによる場合はその限りではありません。

また、当社のシステム以外で、各決済会社や各決済会社提携先等のシステムメンテナンスや不具合によるサービス停止が発生した場合、状況がわかり次第、速やかに加盟店に通知のうえ、原因究明をします。原因判明でき次第、加盟店に通知するようにしますが、当社に起因しない場合、原因判明に時間がかかる場合があることを予めご了承ください。

補足情報

| 決済手段 | 項目 | 仕様差異 |

|---|---|---|

| ソフトバンクまとめて支払い(B) | 解約 |

|

| d払い(キャリア) | 売上方式 |

|

| 購入 |

| |

| 解約 |

| |

| au PAY(auかんたん決済) | 再申込 |

|

| 設定 |

| |

| 支払方法 |

| |

| 当月の部分返金 |

| |

| 楽天ペイ(オンライン決済) | 結果通知 |

|

| PayPay(オンライン決済) | 購入 |

|

| 売上方式 |

| |

| 解約 |

| |

| ユーザー解約通知 |

| |

| プッシュ課金 |

| |

| 継続課金(定期・従量) 申込状態参照 |

| |

| Amazon Pay | システム接続方式 |

|

| 提供機能 |

| |

| 楽天ペイ(オンライン決済)V2 | 結果通知 |

|

| 提供機能 |

|

継続課金(定期・従量)の利用にあたって

継続課金(定期・従量)は、エンドユーザーが継続課金(定期・従量)を申込んだ後は、エンドユーザーの操作なく加盟店の処理のみで決済をすることができるサービスです。そのため、エンドユーザーが申込み内容、課金タイミング等を十分に理解した上でサービスを利用する必要があります。サービス利用にあたり、加盟店が留意・対応する事項は以下のとおりです。

会員管理

- 会員管理や、誤課金防止の制御は、加盟店にて設計・実装してください。

- 加盟店でエンドユーザーを特定できる顧客IDを払い出しの上管理してください。また、継続課金機能を利用する際には、エンドユーザーを特定できる顧客IDを継続課金I/Fで連携してください。

- エンドユーザーがご利用中のサービスやどの決済手段で継続課金を申し込まれたか、会員サービス等で分かるようにしてください。また、継続課金の変更、解除の手続き方法もエンドユーザーにわかりやすく記載してください。

- エンドユーザーがログイン情報等を失念された場合でも、なんらかの方法で継続課金状況の問い合わせ対応や継続課金解約などの対応ができるようにしてください。

継続課金申込み時

- エンドユーザーに利用規約や商品等売買に関する契約内容、条件等を加盟店サイトで明示し、エンドユーザーが十分に契約条件を理解してから継続課金の申込みを行えるようにしてください。

- 申し込んだ後は、エンドユーザーが選択された決済手段で次回以降自動的に決済することを案内してください。特に、継続課金タイミング(毎月XX日に商品出荷後、など)、サービス・商品等の提供タイミング、次回予定日、2回目以降の継続課金に関する注意事項などを記載してください。

- 継続課金の申込みによって払い出された継続課金管理用トラッキングIDは、エンドユーザーと、エンドユーザーが申込みされたサービス・商品等の単位で管理してください。エンドユーザーが申込みされてない別のサービス、商品等の課金に利用しないでください。

継続課金の金額/期間の変更時

- 配送数量や配送タイミングの変更、金額変更などの手続きは、加盟店サイトで設計・実装してください。

- エンドユーザーから継続課金に関する設定変更がされた場合、変更後の金額で決済を行ってください。

- 加盟店のキャンペーン施策などで、決済金額を変更する場合は加盟店からエンドユーザーに適切に案内してください。

- 別のサービス・商品に変更される場合は、改めて、継続課金申込みから行ってください。

継続課金処理時

- 申込み時にエンドユーザーと合意した内容に合わせて継続課金の購入要求処理を行ってください。

- 商品配送・サービス提供前に、エンドユーザーに注文確認(決済予告)通知をすることを推奨します。

- 継続課金処理を行った場合、エンドユーザーに注文メールや配送完了メール等をお送りすることを推奨します。

- 購入金額がエンドユーザーの利用限度額を超過している場合、エンドユーザーの決済サービスのご利用状況、契約状況により決済処理が行えない場合があります。商品の発送やサービス提供前に決済処理を実施することを推奨します。

- 従量課金など、決済処理の前にエンドユーザーへサービスを提供される場合は、上記ケースのように決済処理が行えない場合があることをあらかじめご了承ください。

- 決済処理がエラーとなった場合は、エンドユーザーに通知し、別の支払方法または解約を誘導して運用をお願いします。

- 商品、サービス提供状況に応じて確定処理を行ってください。また決済手段により売上方式、取消可能期間、返金可能期間が異なりますので、運用設計上に考慮お願いします。

継続課金の解約に関して

- 継続課金(定期・従量)の解約について、エンドユーザーにわかりやすく適切に案内してください。

- エンドユーザーから継続課金の解約の申し出があった場合は、速やかに解約処理を行ってください。エンドユーザーから解約申し出後に、継続課金の決済の発生は行わないでください。

- 加盟店サイトのトップページに継続課金解除のリンクを設置してください。リンク名は利用者にわかり易い表示にし、会員、非会員にかかわらずすべてのエンドユーザーに表示するようにしてください。

- 解約される商品名・サービス名をわかりやすく表示してください。また、解約後の提供条件(同月の再申込みが不可、など)についても明記してください。

- 月額利用料等で、エンドユーザーが継続課金解約後、同一サービスを再度お申込みされた場合、原則として月額利用料を二重に課金される事象が発生しないようなサービス提供を行ってください。

※物販等における同一商品の追加購入などの場合はこの限りではありません。 - 解約手続き途中に、強制アンケートや多階層ページフローや多数のリンク設置などはしないでください。

- 解約フローはわかりやすくしてください。エンドユーザーにわかりにくい表現(やめるのをやめる、など)や、解約手続き途中で、解約されたと誤認しやすい表現や記述(ご利用ありがとうございました、など)をしないでください。

- 加盟店サイトにアクセスできないエンドユーザーから、電話/Eメールなどで解約の申し出があった場合は、エンドユーザーと加盟店の間で必ず解決するようにお願いします。

その他

- 課金内容、継続課金の解約方法等について、当社または各決済会社がエンドユーザーより問い合わせを受けた場合には、当社より加盟店サイト上の記載内容、サイト構成について、修正をお願いする場合があります。

- エンドユーザーから利用覚えなし等の申告があった場合、チャージバックとなる場合があります。

- エンドユーザーからの問い合わせが多発し、問合せ内容に対する対応が加盟店サイトで修正できない場合などは、継続課金(定期・従量)の提供を終了することがあります。